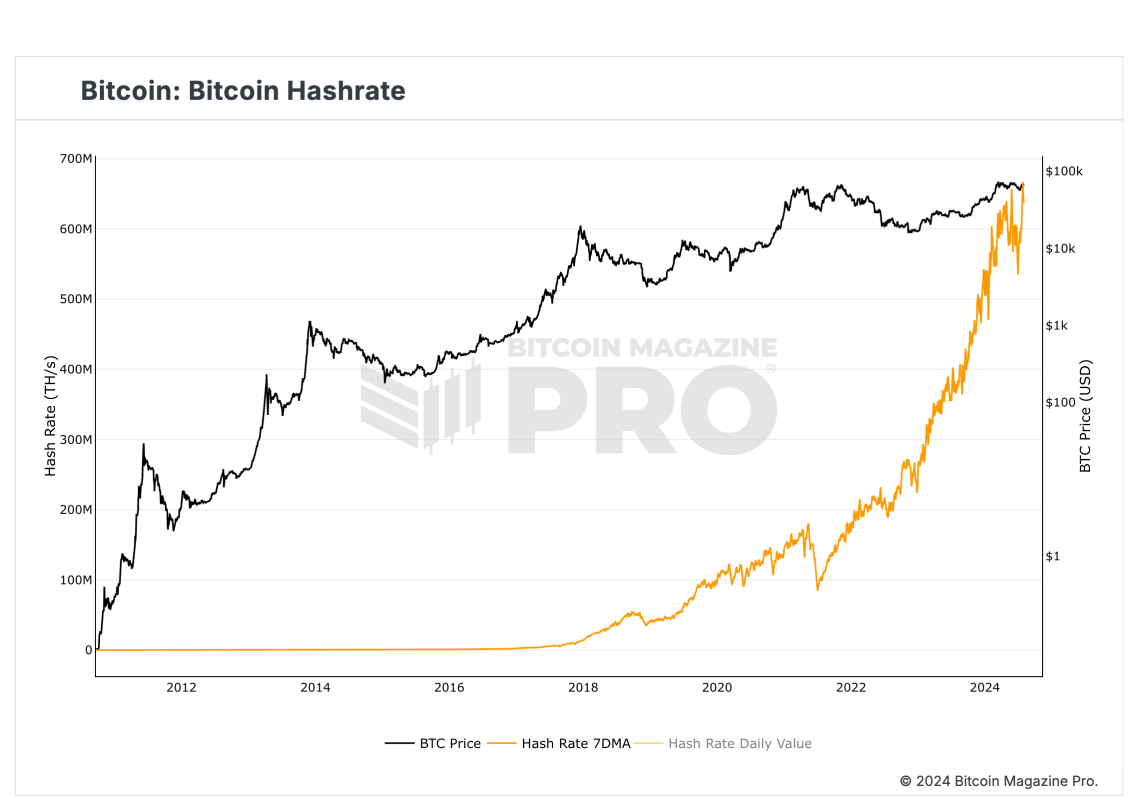

Wow, we finally got $100,000 worth of Bitcoin. What a time to be alive! What started as magical internet money is now a cyberpunk experiment 7th largest wealth Globally, it crossed the $2 trillion market cap. But make no mistake – we’re just getting started. 2025 will be the year of Bitcoin. $100K seems like just a start.

This is my third Bitcoin bull run since entering 2016. From experience, the party is still early. Here’s why I think $100K is just the tip of the Bitcoin iceberg:

- Trump has not yet taken office. The next few years, especially their first year, will likely bring very pro-Bitcoin and crypto regulations.

- The US has not yet started storing BTC. When this happens, it will put every country on notice to adopt Bitcoin as soon as possible.

- Historically, the largest increases occur in the year following a halving due to reduced supply. Now we are at a halt after 2024. you do the math.

- More public companies are adopting Bitcoin treasuries. This trend will increase rapidly in 2025.

- in some US states introduced legislation Holding Bitcoin in reserve. Expect more to come.

- Putin is now Actively Talking About BitcoinIs going through Pro-Crypto Law in russia and national permit Bitcoin and crypto mining. Global acceptance is underway.

The pro-Bitcoin US President aims to make America the global Bitcoin capital, so you better believe we’re going beyond the moon. Game theory says other countries must compete and buy BTC or risk becoming irrelevant.

So no, $100K is not the maximum limit. I would be surprised if we do not exceed historical multiples in this cycle, especially as adoption of the nation-state continues to accelerate. The show is just starting.

Good luck with the $100K, but remember this is only the beginning, my friends. 2025 will be Bitcoin’s breakout year as it solidifies itself as a global reserve asset. I’m incredibly optimistic – stay strong for the exciting journey ahead!

This article is a TakeThe opinions expressed are solely those of the author and do not necessarily reflect the opinions of BTC Inc. or Bitcoin Magazine.