Wouldn’t this be very good if we have an all-surface metric to guide our bitcoin investment decisions? It is okay what is made, bitcoin everything indicators. Recently added to Bitcoin Magazine Pro, this indicator is aimed at consolidating several matrix in the same structure, which has to be more streamlined than bitcoin analysis and investment decision making.

To watch more deeply on this subject, watch youtube videos recently: Official bitcoin everything indicator

Why do we need a comprehensive indicator

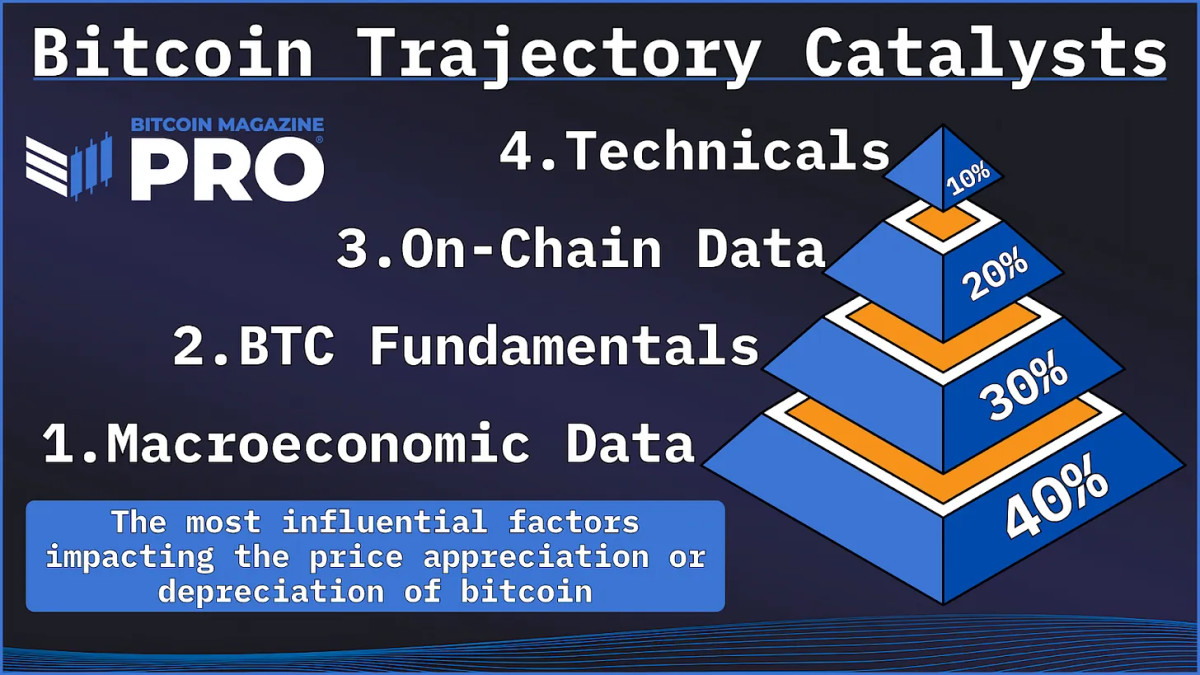

Investors and analysts typically rely on various matrix, such as on-conce, technical analysis and derived charts. However, focusing too much on one aspect can lead to an incomplete understanding of the price movements of bitcoin. Bitcoin everything indicators Attempt to solve the major components by integrating it in a clear metric.

View live chart

Bitcoin’s main component everything indicators

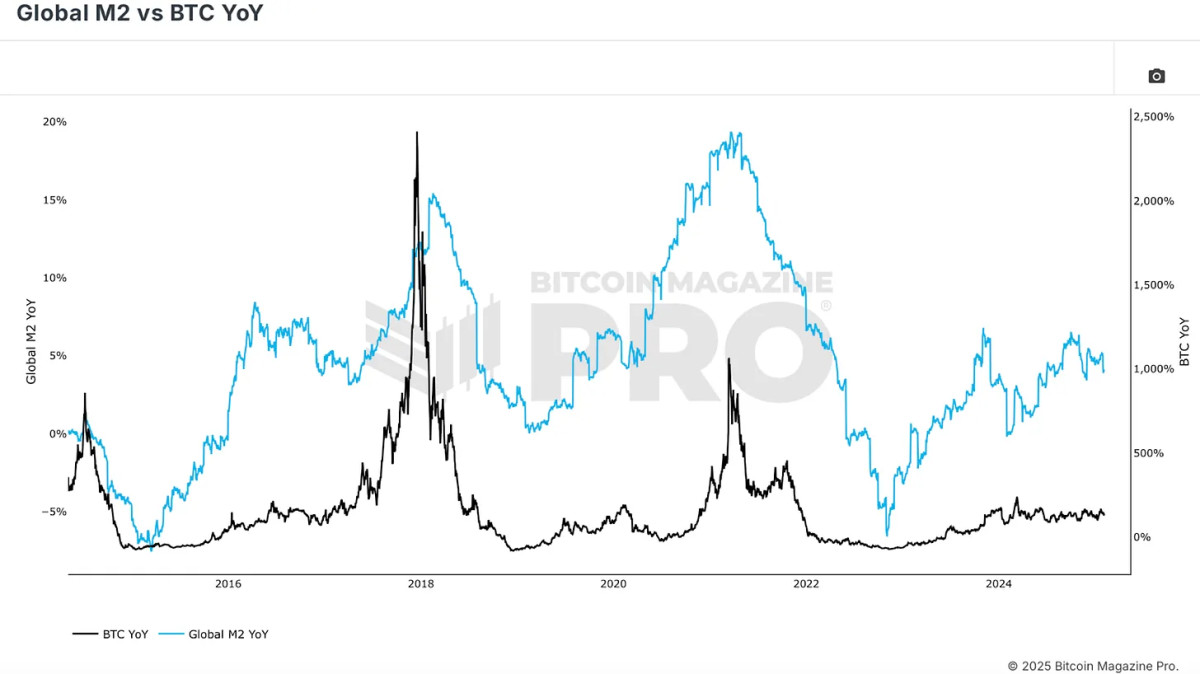

The value action of bitcoin is affected deeply by global liquidity cycles, making the comprehensive economic condition become a fundamental column of this indicator. Relationship between bitcoin and broad financial markets, especially in terms of Global M2 money supplyIt is clear. When liquidity expands, bitcoin usually appreciates.

View live chart

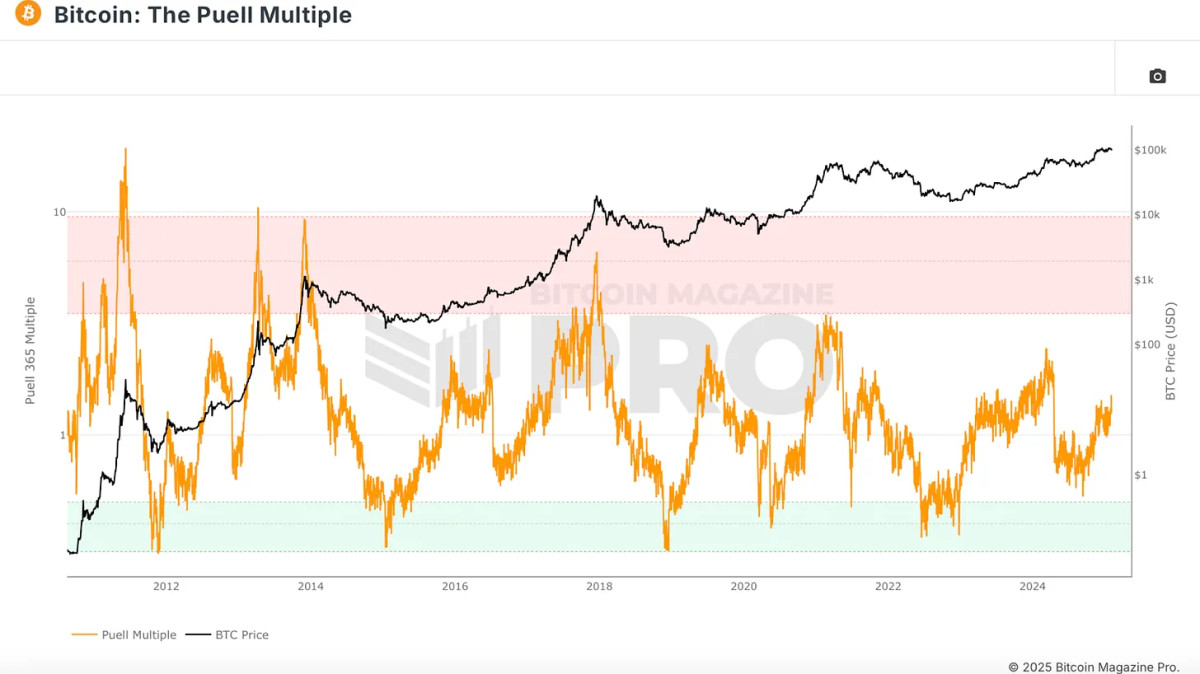

Fundamental factors such as bitcoin’s AIR cycle and mineral power play an essential role in its evaluation. While halvings reduce the supply of new bitcoins, their impact on price appreciation is reduced as more than 94% of the total supply of bitcoin is already in circulation. However, mining is important. Puel multiple, which measures mineral revenue relative to the historical average, provides insight into market cycles. Historically, when mineral profitability is strong, bitcoin is in a favorable position.

View live chart

On-chain indicators help to assess the supply of bitcoin and the dynamics of demand. MVRV Z-ScoreFor example, the market cap of bitcoin is compared to its feeling cap (average purchase price of all coins). It identifies metric accumulation and distribution areas, when bitcoin is overvalized or underwellized, is highlighted.

View live chart

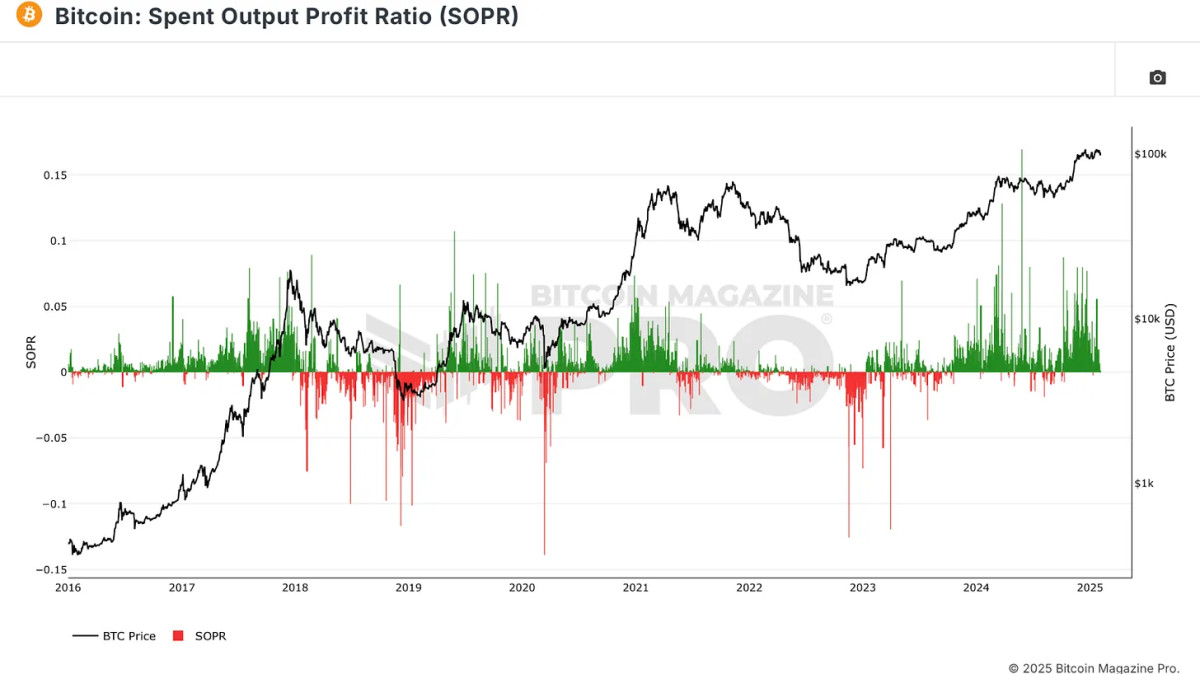

Another important on-chant is metric Spending production ratio (sopr)The one who examines the profitability of the coins being spent. When bitcoin holders realize large -scale profits, it often indicates a market peak, while high losses indicate market bottom.

View live chart

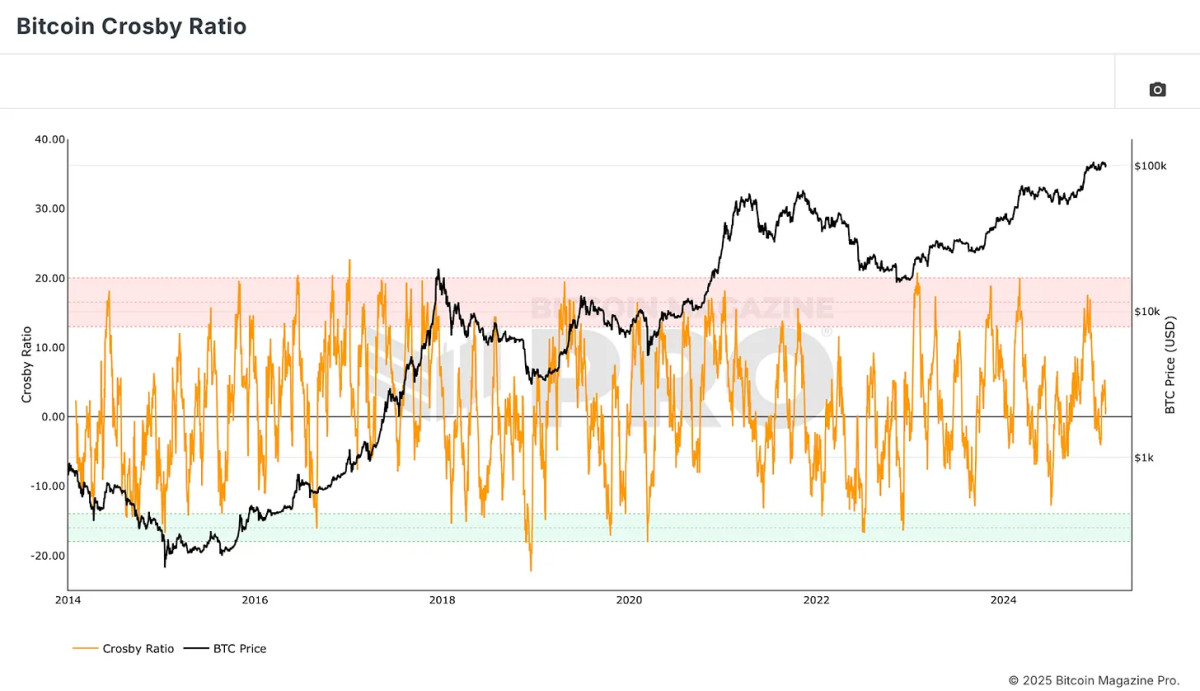

Bitcoin crossbal ratio There is a technical metric that assesses overactive or discounted conditions of bitcoin that is based on purely value action. This ensures that market sentiments and speeds are also attributed to bitcoin everything indicators.

View live chart

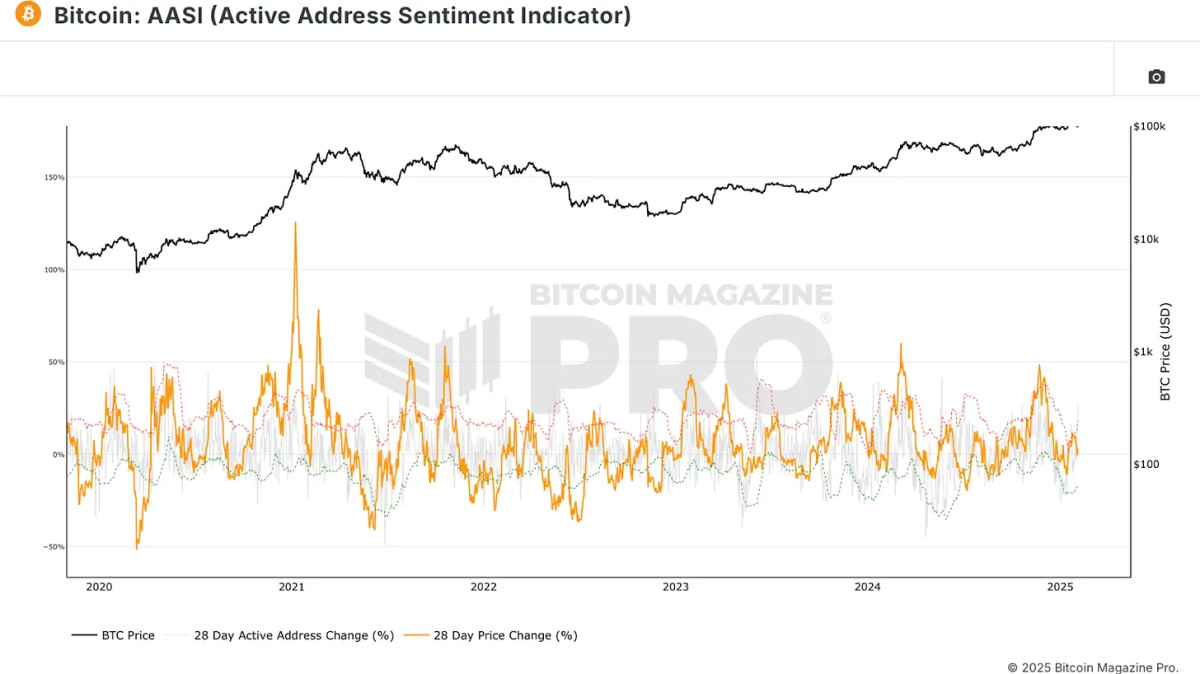

Network use can provide important clues about the strength of bitcoin. Active address spirit indicator Measures a percentage change in active address in 28 days. The increase in active addresses usually confirms a rapid trend, while stagnation or decline may indicate the weakness of the value.

View live chart

Bitcoin how everything indicators work

By combining these various matrix, bitcoin everything indicators ensure that no factor is given unfair weight. Unlike the models that rely too much on specific signals, such as the MVRV Z-score or PI cycle, this indicator distributes the effects equally in many categories. This prevents overfiting and allows the model to be compatible with changing market conditions.

Historical performance vs. purchase-and-catch strategy

One of the most striking findings is that bitcoin everything indicators have improved a simple purchase-and-hold strategy because the price of bitcoin was less than $ 6. Using the strategy of depositing bitcoins during oversold conditions and gradually selling in overbott zone, investors using this model would have greatly increased their portfolio performance with a low dradown.

For example, this model keeps a 20% decline in the history of bitcoin compared to a decline of usually 60–90%. This suggests that a well-balanced, data-operated approach can help investors make more informed decisions with low risk risk.

conclusion

Bitcoin everything indicators simplify the investment by merging the most important aspects that affect the price action of bitcoin into a metric. It has historically improved the purchase-and-catch strategies, reducing the risk, making it a valuable tool for both retail and institutional investors.

See for more detailed bitcoin analysis and to reach advanced facilities like live charts, personal indicators alert and in-depth industry reports, Bitcoin magazine pro,

Disclaimer: This article is only for informative purposes and should not be considered financial advice. Always do your own research before making any investment decision.