reason to believe

Strict editorial policy

Carefully reviewed by industry experts

The highest standard in reporting and publication

Strict editorial policy

Morbi Pratium Leo et Nisl Elikum Molis. Quisk Arcu Loram, Ultris Quis Palenttec NEC, Ulkmopper EU Odio.

Esteculo Tambinene Esta Disponible N Esponol.

The climb of bitcoin collected fresh speed on Tuesday, charged above a mark of $ 94,000 and increased the profit by 26% since April 9. Three interlocking forces-gropolitics, demand for strategic balance-sheet, and revival-business-trade-funds up to 24 hours of the past to ignite the flow-rally.

Why is there bitcoin today?

The first spark came from Washington, where US President Donald Trump indicated a partial dentant in his long -running tariff controversy with Beijing. Sitting behind the lecture at the White House, Trump announced that the duties on Chinese imports “would come down to a large extent, but it would not be zero,” before the two sides would reach a deal until it will “be great for China”.

Macro Economist Alex Krugar Distilled The President’s comment in a widely operated X post, given that Trump “just ticks the dysmike / fast box.” In words, the phrases highlighted the crude: “Tariff on China will not be 145%as high,” “It would come down to a large extent,” and, when asked if he was asked if he would “play hardball,” the President’s juicy “no.”

Related reading

Equity indices immediately responded, but bitcoin’s move was more dramatic, outlining the market sensitivity to the macro uncertainty – and for any indication that the path of the Federal Reserve can tilt more dowish, which should trade friction.

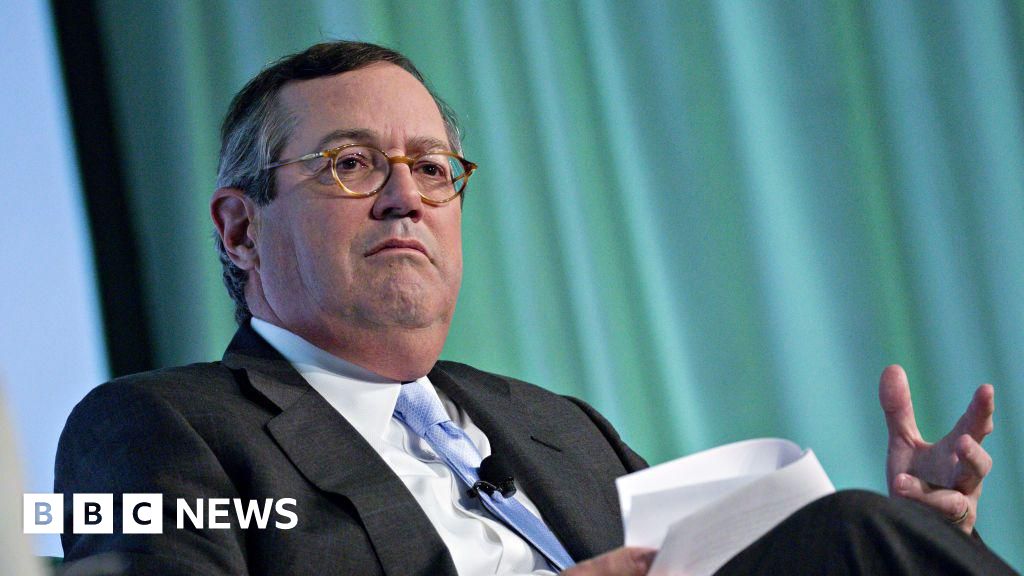

While the geo -politics sets tone, another catalyst Arrived from Wall Street: Possibility of bidding a multibillion-dollar balance-sheet for bitcoin by the next generation of the Lutynic Family. According to the Financial Times, Brandon Lutnik – Cancer is formed “canter equity partners” at the concert with SoftBank, Tithi and Bitfine, son of Cancer Fitzgerald and son of Commerce Secretary Howard Lutnik.

The Consortium planned to seed a new unit, 21 capital, with about $ 3 billion in bitcoin. Tithitan intends to contribute $ 1.5 billion property, about $ 900 million, Softbank, and to contribute about $ 600 million to Bitfinex, the report states that the number may still move before the expected formal announcement in the coming weeks.

On X, Taxas Bitcoin Foundation Board member Tur Demester clearly implicated the implications: “This declaration can explain why bitcoin is 12% in the last week.”

Related reading

The third stage of support came from the US Spot Bitcoin ETF market, where the income returned decisively in the positive field. The data compiled in issuers show overall Interformation On Tuesday, $ 911.2 million-the most powerful daily since January 17, when Precious Oddism produced $ 975.6 million around Trump’s “Crypto President”.

Fedibility’s FBTC absorbed $ 253.8 million, RKB of Arc Investment attracted $ 267.1 million, and Blackrock’s market-Agni IBIT IBIT pairs $ 192.1 million, while the small Grassscale Bitcoin Trust (GBTC) vomited the Mochan’s week with $ 65.1 million.

The turnaround began on Monday, when Kohrport attracted $ 381 million-dominated the stretch of a multiplication in the outflow-and Bitcoin gathered the speed as cleaning the range of $ 90,000. The two-day, $ 1.29 billion surge indicates a physical revival of institutional hunger.

At the press time, BTC traded at $ 94,212.

Image made with Dall.E, chart from traudingview.com