Bitcoin appears to be on the verge of a major value movement, and the data suggests that instability may return on a large scale. With the price of bitcoin being stable in action in the last few weeks, let us analyze key indicators to understand the possible scale and direction of the upcoming steps.

Unstable

Start is a great place to start Bitcoin volatilityWhich tracks value action and instability over time. By separating the data of the previous year and focusing on weekly instability, we believe that the price of bitcoin has recently been relatively flat, lovering in the range of $ 90,000. This prolonged side action has led to a dramatic decline in instability as a result of a dramatic decline, meaning that bitcoin is experiencing some of its most stable value behavior in recent history.

View live chart

Historically, such low instability levels are rare and short -lived. When looking at previous examples, where instability was low, bitcoin pursued with significant value movements:

$ 50,000 to one rally until all time of $ 74,000.

The decline ranging from $ 66,000 to $ 55,000, followed by another increase from $ 68,000.

The duration of a stagnation of around $ 60,000 before growing to $ 100,000, its current all-time high.

Each time instability fell at this stage, bitcoin experienced a move of at least 20–30%, if not too much, in the next weeks.

Bollinger Bands

To confirm this, the Bollinger band width indicator, a device that measures volatility by tracking the price deviation from a moving average, also indicates that bitcoin has been coarsed for a large step. The quarterly bands are currently at their tight levels since 2012, which means the price compression is at one peak. The last time this happened, Bitcoin experienced a 200% price increase within weeks.

While examining the previous events of the same tight bollinger band setup, we find:

2018: Fall by $ 6,000 to $ 3,000 by 50%.

2020: A breakout from $ 9,000 to $ 12,000, the final rally was installed up to $ 40,000.

2023: A slow accumulation phase of around $ 25,000 before jumping rapidly up to $ 32,000.

Potential direction

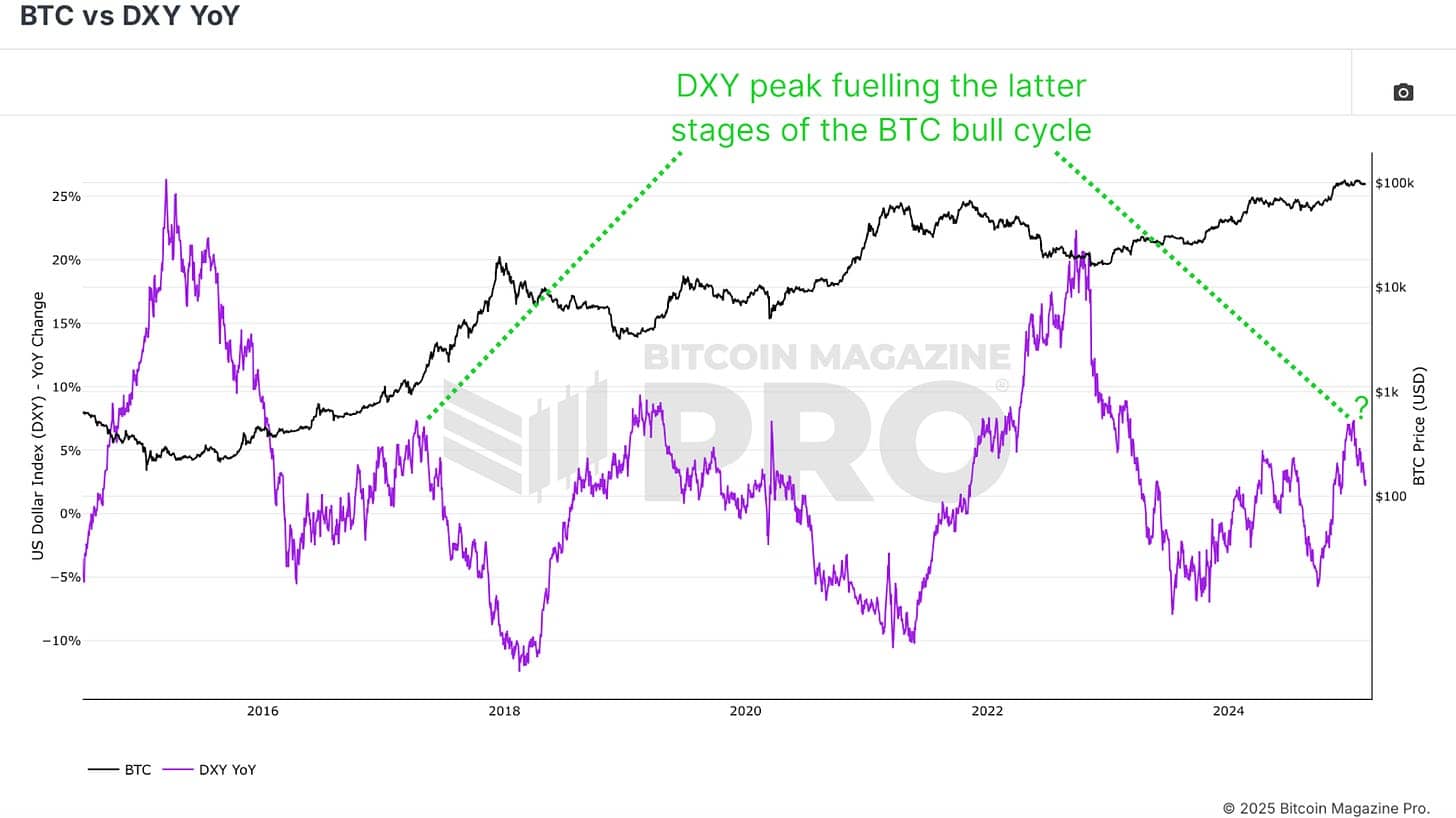

Understanding the direction is hard to predict instability, but we have clues. Is a strong indicator US Dollar Strength Index (Dxy) YoyWhich has historically become opposite bitcoins. Recently, DXY is holding a hard rally, yet Bitcoin has kept its land. This shows that bitcoin has the underlying strength, even in less favorable macro conditions.

View live chart

Additionally, political factors can play a role. Historically, when Donald Trump took over in 2017, DXY recorded a decline, and Bitcoin ran a large -scale bull from $ 1,000 to $ 20,000. With potentially a uniform setup in 2025, we can see the repetition of this dynamic.

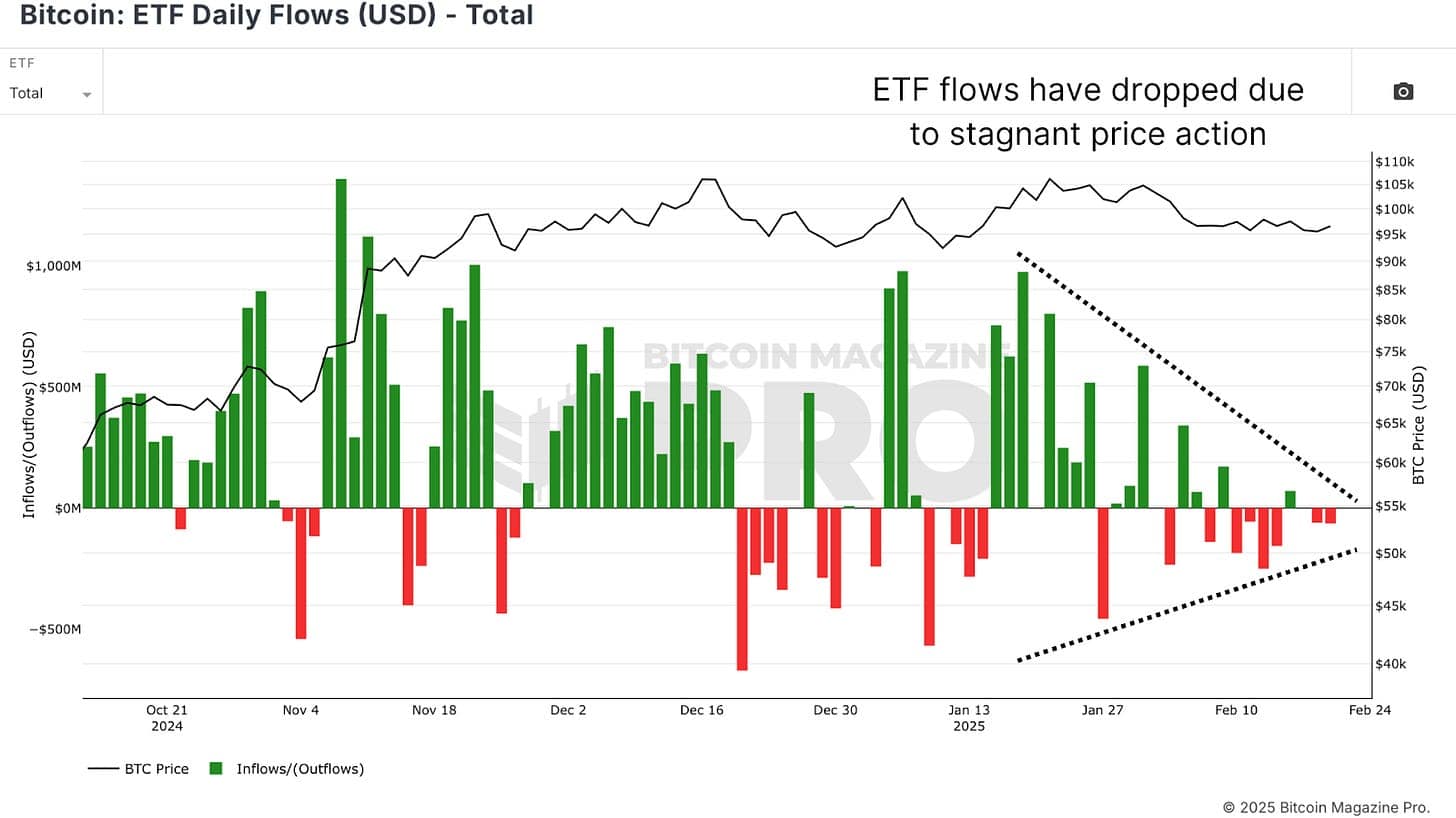

ETF inflow

Also, bitcoin ETF inflowA proxy for institutional demand has slowed significantly during this period of low instability. This shows that the major players are waiting for a confirmation breakout before adding their positions. Once the instability returns, we can see renewed interest from the institutions, driving bitcoins even more.

View live chart

conclusion

The instability of bitcoin is one of its lowest levels in history, and such situations have never long been long. When instability is compressed in this way, it determines the phase for an explosive move. Data suggests that a breakout is adjacent, but whether it bends rapidly or the recession depends on the macroeconomic conditions, investor spirit and institutional flow.

See for more detailed bitcoin analysis and to reach advanced facilities like live charts, personal indicators alert and in-depth industry reports, Bitcoin magazine pro,

Disclaimer: This article is only for informative purposes and should not be considered financial advice. Always do your own research before making any investment decision.

![You’ll Probably Never Guess What Live Musical Performance Blew This Sinners Star Away [Exclusive] – SlashFilm Trending Global News You’ll Probably Never Guess What Live Musical Performance Blew This Sinners Star Away [Exclusive] – SlashFilm Trending Global News](https://www.slashfilm.com/img/gallery/youll-probably-never-guess-what-live-musical-performance-left-a-mark-on-this-sinners-star/l-intro-1745021921.jpg)