Data suggests that the Bitcoin Fear and Greed Index recorded a sharp jump after recovering the property price above $ 81,000.

Bitcoin fear and greed index is now pointing to ‘fear’

“Fear and greed index” is an indicator Option This tells us about the average feeling among investors in bitcoin and broad cryptocurrency markets.

Index uses the numerical scale running from zero to hundred hundred to represent the investor mentality. All values above 53 correspond to a feeling of greed, while people under 47 are people. The lies between these two cutoffs suggest a pure neutral sentiment.

Now, what is the spirit of the current market here, according to fear and greed index:

The value of the metric appears to be 39 at the moment | Source: Alternative

As displayed above, the bitcoin fear and greed index is currently a value of 39, which means that the average trader in space has a feeling of fear. The frightened mentality is not very strong, however, as indicators, only 8 units are away from the neutral region.

Yesterday was different, however, as Metric kept the value of 18. This level of FUD was so strong that it was inside a particular area known as extreme fear (25 and less). For indicators it came as a low bitcoin and crashed around uncertainty around other tariffs.

For most countries with US President Donald Trump, a 90 -day stop at tariffs, some recovery in prices has been observed, which naturally allows for the upliftment in the market mood.

The trend in the Fear & Greed Index over the past twelve months | Source: Alternative

While the fear and greed index has jumped back for now, it is unknown how long the recovery will remain. From the chart above, it appears that the metric has recently been very up and down, which means that investors have been fed.

Historically, Bitcoin and Altcoin Bazaar have tried to move forward in the direction that the crowd expects at least. For example, the extreme fear, where Fud has been the strongest, has often paved the way for market bottles. The BTC was just inside the extreme fear area, so it is possible that it may be a bottom. If so, the latest recovery can be one to one.

However, it should be noted that in the end of February, the index hit 10 of the 10, and while it matched with the low, it was not clearly the main floor. Thus, it only remains to be seen how things will play at this time.

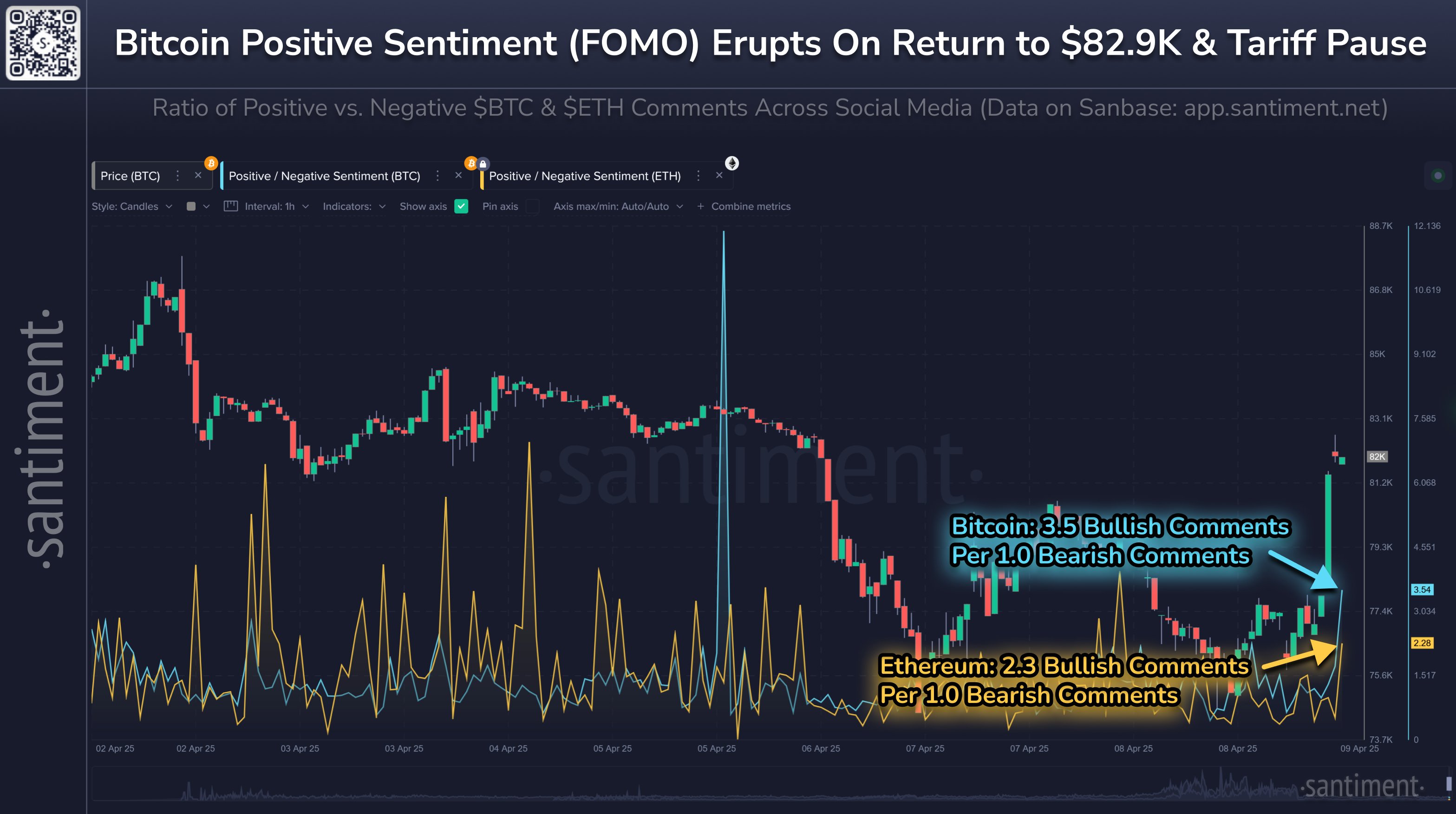

Fear and greed index closes their value from several factors, one of which is a feeling on social media. One in Post On X, the Analytics firm Santime has talked about how this aspect of market spirit has changed after two biggest digital assets after tariff poses news for bitcoin and atherium.

The data of the ratio between the positive and negative sentiments on social media | Source: Santiment on X

It seems that the news was rapidly erupted on social media platforms after the news, with 3.5 and 2.3 positive comments coming for every negative post related to bitcoin and atherium.

BTC Price

At the time of writing, Bitcoin is trading around $ 81,500 up to 6% in the previous day.

Looks like the price of the coin has seen recovery in the last 24 hours | Source: BTCUSDT on TradingView

Dall-e, image painted from Santiment.net, chart from tradingView.com

Editorial process Focus on giving full research, accurate and fair content for bitcoinists. We maintain strict sourcing standards, and each page undergoes hardworking review by our team of top technology experts and experienced editors. This process ensures the integrity, relevance and value of our content for our readers.