reason to believe

Strict editorial policy

Carefully reviewed by industry experts

The highest standard in reporting and publication

Strict editorial policy

Morbi Pratium Leo et Nisl Elikum Molis. Quisk Arcu Loram, Ultris Quis Palenttec NEC, Ulkmopper EU Odio.

Esteculo Tambinene Esta Disponible N Esponol.

Bitcoin price action in last 48 hours Have seen that it is coming $ 80,000 level level again, with the risk of rupture of the negative side. Given on-chain data shows a remarkable support level between $ 80,920 and $ 78,000 It should not be broken.

Related reading

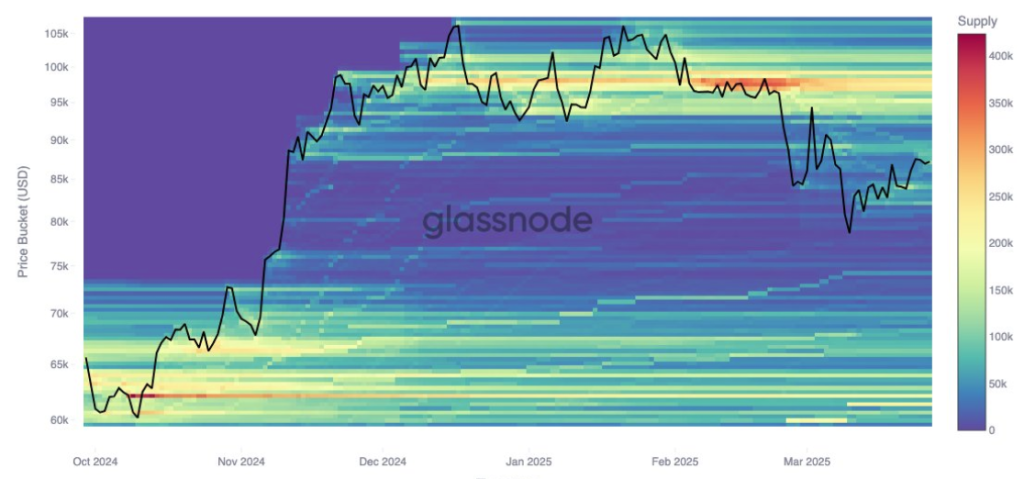

In particular, on-chain analytics from Glasanode indicates the thinning of support at the level of $ 78,000, where now only the minimum cost base clusters are present. The insight follows a sharp trick, seen that the loving traders scored about 15,000 bitcoins on 10 March before the loving traders cache $ 87,000 on the local top.

Support cushion grows with groups between $ 80,000 and $ 84,000

Bitcoin started the month of March with a crazy accident, with its price to be reduced by $ 77,000 on March 10 and March 11. Most of the month of the month was spent on recovery from this level by bitcoin, eventually reaching $ 88,500 last week.

Interesting, Chen data from Glasanod shows that some bitcoin traders took advantage of the accident And bought About 15,000 BTC on this low. However, several addresses of the same corort were sold on the local top of $ 87,000, which overtakes a buffer buffer zone, which can no longer offer equal value stability.

The strongest cost base groups of bitcoin have migrated up to $ 78,000 continuously throughout the month, the most prominent support level is now sitting between $ 80,920 and $ 84,100. About 20,000 BTC was acquired at $ 80,920, 50,000 BTC $ 82,090 and at about $ 84,100 in another 40,000 BTC. These latest accumulation is now new areas of confidence among recent buyers that can provide cushions for recent market dip.

At the time of writing, Bitcoin is trading at $ 83,120, which means that it has lost the area of 40,000 BTC around $ 84,100. It puts $ 82,090 and later, $ 80,920 value level. However, if the improvement intensifies further, it will not be after $ 78,000 Structural support rebuilt In $ 74,000 and $ 71,000, where long -term sentence was purchased, 49,000 BTCs and 41,000 BTC are estimated respectively.

image X: From Glasanode

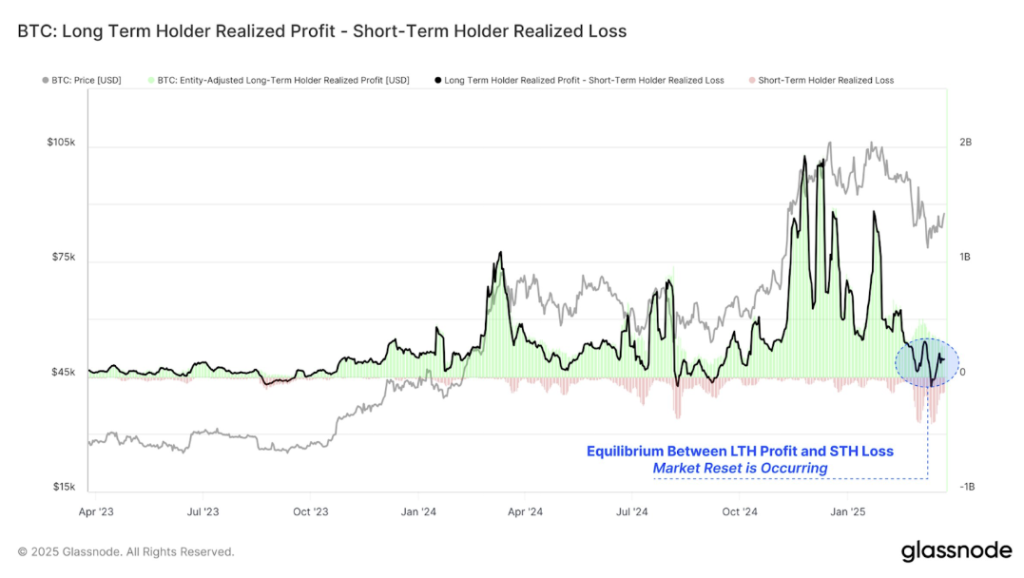

$ 95,000 cost base cluster increases with cooling demand

Since support continues to climb slowly, Resistance seems to firming Near a mark of $ 95,000. The data based on investor costs shows the growth of 12,000 BTC at this stage from 24 March.

This implies that some investors now estimate a top of around $ 95,000, and if prices reach that zone, the sales activity can be more pronounced. This resistance, with support levels, can see bitcoin limited within a narrow range in short term.

Related reading

Gliffonode data Confirms that Long -term holders (addresses with bitcoin for more than 150 days) have been the primary source of taking advantage for some time. Taking advantage of long -term holders is now almost matched Damage by Short -term traders who have been bitcoin for less than 155 days.

image X: From Glasanode

Special displayed image from Tech Research online, chart Tradingview