Esteculo Tambinene Esta Disponible N Esponol.

The DOGECOIN (DOGE) holders are placed on alert by Crypto analyst Ali Martinez, who shared a chart on Monday highlighting a remarkable technical setup. According to Martinez, the market value for the realization price (MVRV) ratio for Dogi formed its own 200-day moving average (MA)-formed “Death Cross” with an event, which first with a decline in the major value Was correlated.

Dogcoin mvrv death cross warning

Martinez’s chart, sour from the century, plots three major data points: DOGE/USD Price (Black Line), DOGE’s MVRV ratio (orange line) and 200-day MVRV ratio of DOGE MA (Red Line). He Comment: “Dogi saw only the MVRV ratio and a cross of a death between its 200-day MA. This happened in the last two times, prices fell 26% and 44%. ,

The new printed “Death Cross” is where the Orange MVRV ratio line falls below the red 200-day MA line. Historically, the price of analyzer notes, Dogge experienced two significant reforms after this crossover: the beginning of September and the end of October 2023 falls 26% and a decline of 44% from mid -June to the end of September 2024 to the end of September 2024.

Related reading

Both recession appear in shaded areas on the chart, accordingly labeled. After each of these, the price of dogcoin eventually overturned, but only after reaching a low price level. Looking closely on the chart, the price of dogcoin is shown to be trading around $ 0.268. The MVRV ratio (orange line) climbed near 91%, while the 200-day MVRV ratio MA (red line) is about 78.36%.

The MVRV ratio compares the current market value of DogeCoin to its actual value (the collected cost base of DOGE last time-chain). A MVRV of 91% indicates that the market participants, on average, may be quite relative relative to their procurement price – if the ratio remains above 1. Although the accurate interpretation depends on how an analyst applies to the MVRV scale, a high MVRV ratio means that a high MVRV ratio means an increase in unrealistic gains between holders.

Related reading

The 200-day MVRV MA is a simple moving average of the MVRV ratio in the last 200 days. This provides a long -term base line of how far the current MVRV of Dogicine is above or below its historical trend. A “Death Cross” in this context appears when the short-term MVRV ratio (orange line) 200-day MVRV ratio moves under the MA (red line), often indicates a possible change in emotion or adjacent sales pressure.

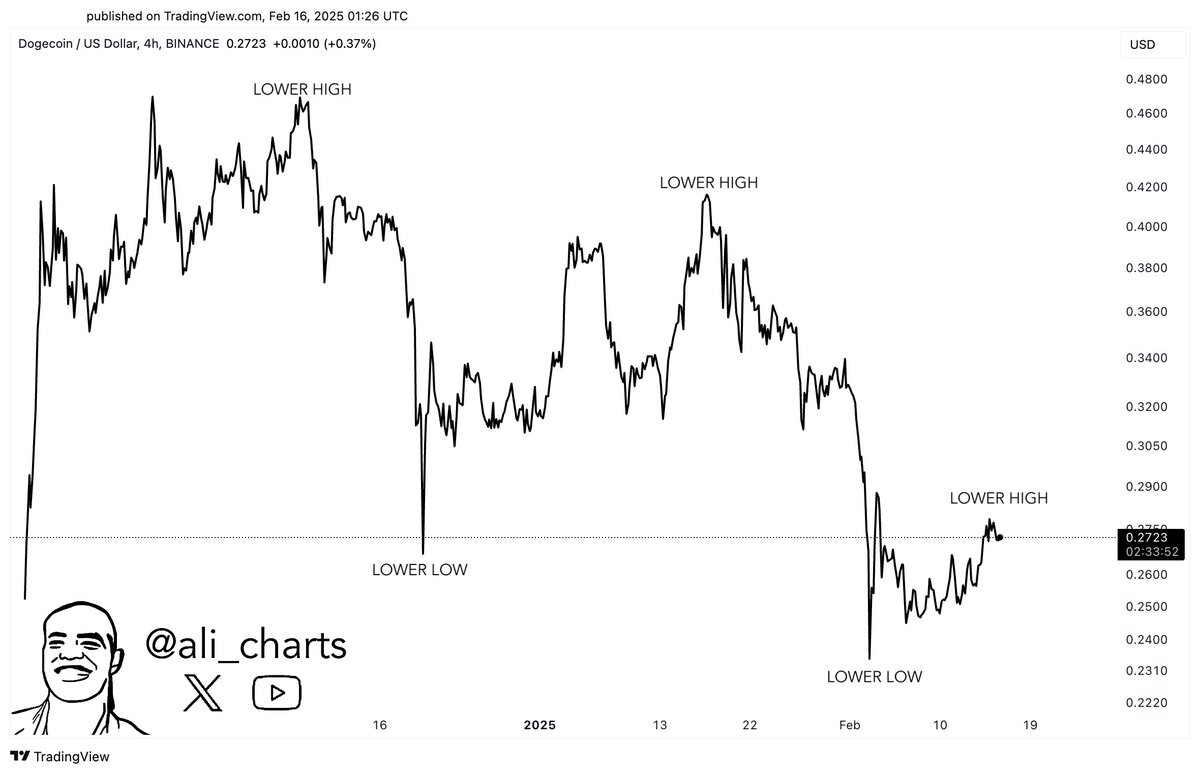

In particular, the price of dogcoin has been showing some weakness in the last few weeks. Since 8 December at $ 0.4834, Dogge is consistently low -high and lower climbing, writing a highly recession chart setup. Martinez shared the chart below and Stated: “Dogi lives in a downtrend, which creates lower climb and lower height. The speed requires a breakout above the major resistance to move the speed! ,

To get this, Dogge will need to be broken above $ 0.44. However, Dogi Bulls can expect significant resistance to $ 0.31 (0.382 Fibonacci Retration Level), $ 0.342 (0.5 FIB) and $ 0.375 (0.618 fib). At the press time, Dogi traded at $ 0.26.

Image made with Dall.E, chart from traudingview.com