The atherium is 55% below its December high, indicating widespread weakness that hit the crypto market amidst increasing global uncertainty. Most of the recent pressure came from US President Donald Trump’s aggressive tariff policies and unpredictable economic trend, assuring investors and inspired a risk-feeling in financial markets. A high-stagnant property such as atherium has been particularly difficult hits, in which bulls are struggling to hold significant support levels and sellers dominate short-term value action.

Despite the recession approach, on-chain data offers a glimpse of hope for the long-term possibilities of the atherium. According to Cryptoctive, the Atherium Exchange Reserve since 2022 has steadily declined – a trend that suggests a continuous decrease in supply available on centralized platforms. Although it has not yet been translated into value action upwards, it once indicates a possible supply squeeze after the demand return.

For now, ETH remains under pressure with immediate signs of a reversal, but the supply of shrinking exchange can determine the platform for a strong rally if buys interest. Till then, the atherium continues to trade in a delicate position, with investors closely seen for signs of support or further breakdown in the coming weeks.

Ethereum tests important support as tests

Ethereum is testing the level of significant demand as the market continues to be slow. After weeks of continuous sales pressure, Eth is now trading below the level of $ 1,800 – an area that see many analysts as the last line of defense before deep loss. The broad macroeconomic backdrop remains challenging, with the risk of business warnings and tightening the financial conditions under the possibility of the business war.

The atherium has been particularly weak since the end of February, when the bulls lost control after a breakdown below $ 2,500. Since then, price action has steadily declined, and a rapid cycle expectations have faded. The investor’s spirit is critical, and the bulls have to show sufficient strength to retrieve the broken support levels or start a meaningful recovery.

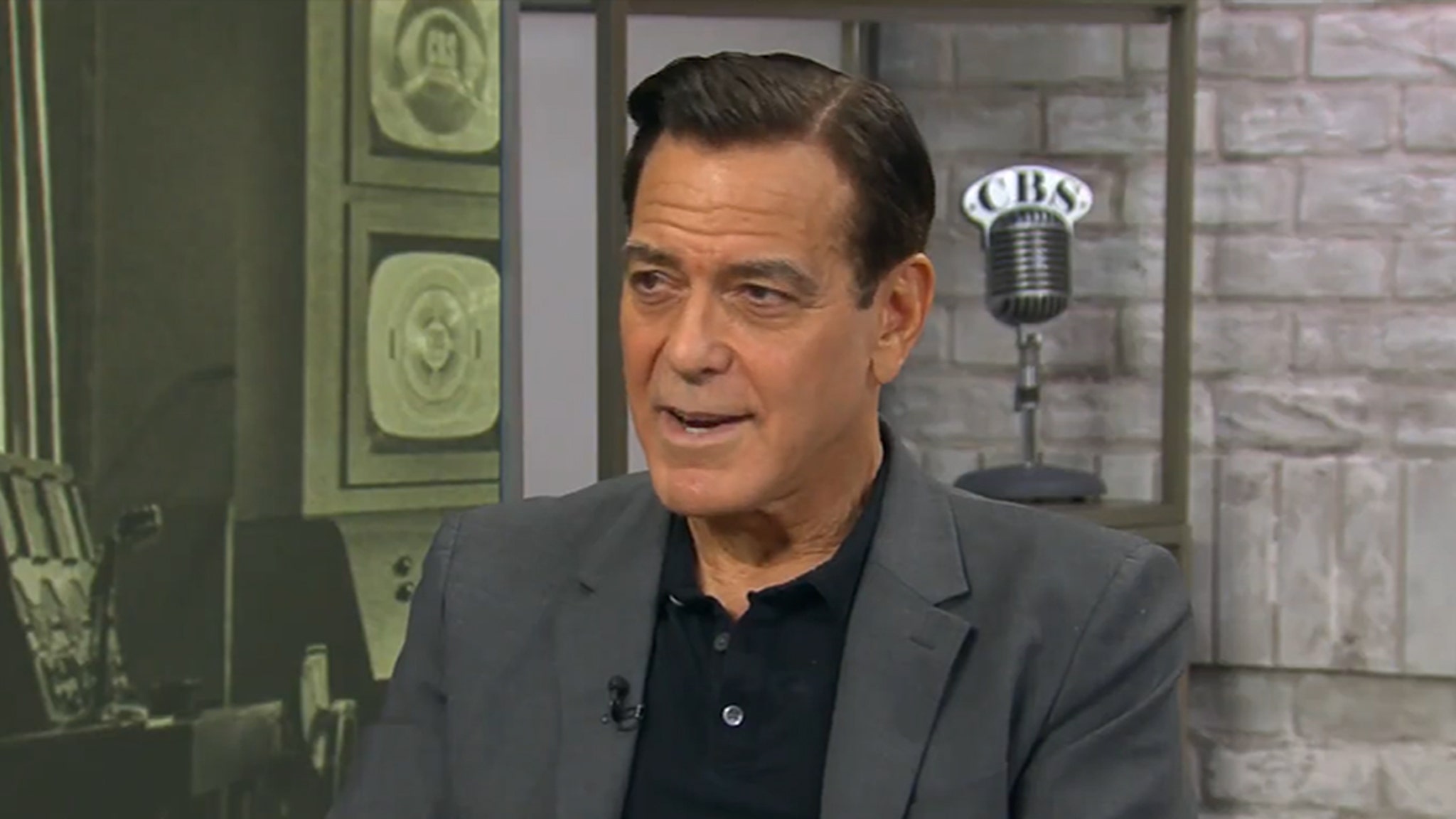

However, there are signs of long -term potential building below the surface. The top analyst Quinton Francois, ETH supply on exchanges, is plmeting. Shared via X, cryptoctive data shows an important dowstrend in the atherium held on centralized platforms-one sign is that investors can move the property into cold storage, reduce sales-side pressure.

This decline in the supply of exchange is historically before the rapid breakout. Once the demand returns and values become consolidated, thin supply on exchanges can serve as fuel for a sharp rally. While the current conditions remain recession, the structural decrease in the available ETH offers a compelling setup for future rebounds.

For now, Etreum should hold a deep slide to hold $ 1,750- $ 1,800 above the range, but longer holders are looking closely for the time when the holders are closely looking at when low supply meets the pressure to buy renewed.

ET trade under major weekly indicators

Ethereum is currently trading below both the 200-day moving averages (MA) and $ 2,250 nearly $ 2,500, trading below both average moving average (EMA)-Long-term indicators who now act as overhead resistance. This breakdown highlights the severity of the ongoing improvement with the bull under heavy pressure to prevent further damage. Ath is now molesting its lowest weekly shutdown since October 2023, adding concerns that the downtrend may be deep if buyers fail to step up soon.

Momentum remains weak, and fast attempts to recover have been short -lived, as there is a massive economic instability and the weight of pressure sales on the comprehensive crypto market. To avoid ethereum and to avoid the negative side, it must wear $ 1,800 level – a major demand area and psychological range.

If bulls manage to protect this level and reconstruct the $ 2,000 mark in the coming days, it may indicate the introduction of a recovery rally. Re -formation of this range will transfer emotion and possibly trigger a fresh purchasing interest. Till then, the ETH remains insecure, and can open the door for a reetest of a lower support levels close to $ 1,800, potentially accelerates the decline if the emotion further deteriorates.

Specially displayed image from Dall-E, chart from tradingview

Editorial process Focus on giving full research, accurate and fair content for bitcoinists. We maintain strict sourcing standards, and each page undergoes hardworking review by our team of top technology experts and experienced editors. This process ensures the integrity, relevance and value of our content for our readers.