With Bitcoin now in six-figure territory common and higher prices seemingly an inevitability, analysis of key on-chain data provides valuable insight into the underlying health of the market. By understanding these metrics, investors can better predict price movements and prepare for potential market tops or even any upcoming retracements.

terminal price

terminal price metrics, including The days of coins are gone (CDD) Considering Bitcoin supply has historically been a reliable indicator for predicting Bitcoin cycle peaks. Coin Days Destroy measures the speed of coins being transferred, taking into account both the holding period and the amount of Bitcoins.

View Live Chart

Currently, the price of the terminal has crossed $185,000 and is likely to rise to $200,000 as the cycle progresses. Since Bitcoin has already broken $100,000, this suggests that we may still face several months of positive price action.

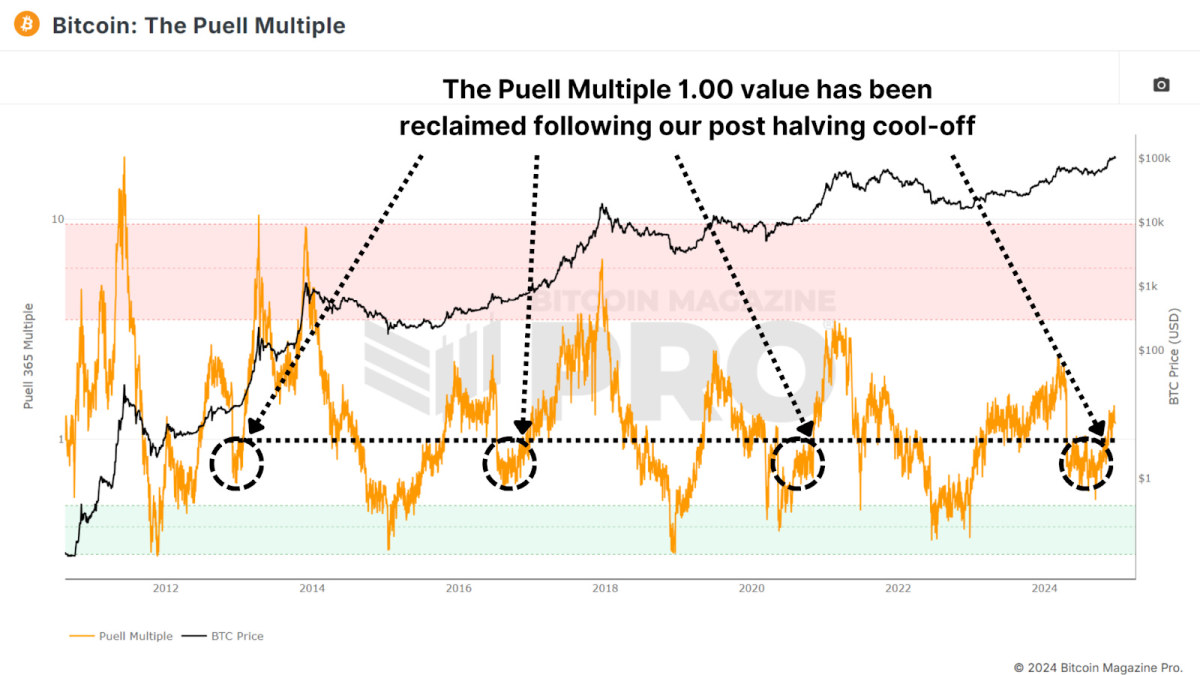

puel multiple

puel multiple Evaluates daily miner revenue (in USD) relative to its 365-day moving average. Following the halving event, miners experienced a sharp decline in revenues, leading to a period of consolidation.

View Live Chart

Now, the PUEL multiple has climbed above 1, signaling a return to profitability for miners. Historically, crossing this range signals the later stages of a bullish cycle, often marked by exponential price rallies. A similar pattern was seen during all previous bull runs.

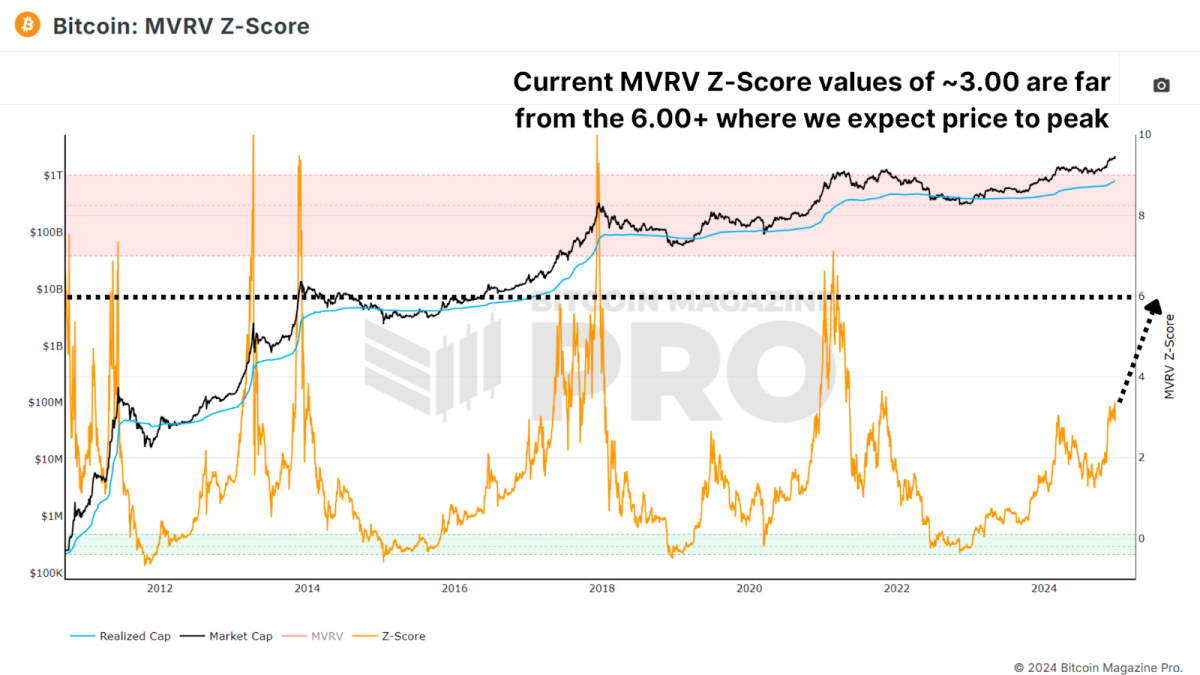

MVRV Z-Score

MVRV Z-Score Measures market value relative to the real value (based on the average cost of Bitcoin holders). Taking into account asset volatility that is standardized into a Z-score, it is highly accurate in identifying cycle peaks and troughs.

View Live Chart

Currently, Bitcoin’s MVRV Z-score remains below the red hot zone with a value of around 3.00, indicating that there is still room for growth. While there has been a trend of declining peaks in recent cycles, the Z-score shows that the market is far from reaching an euphoric top.

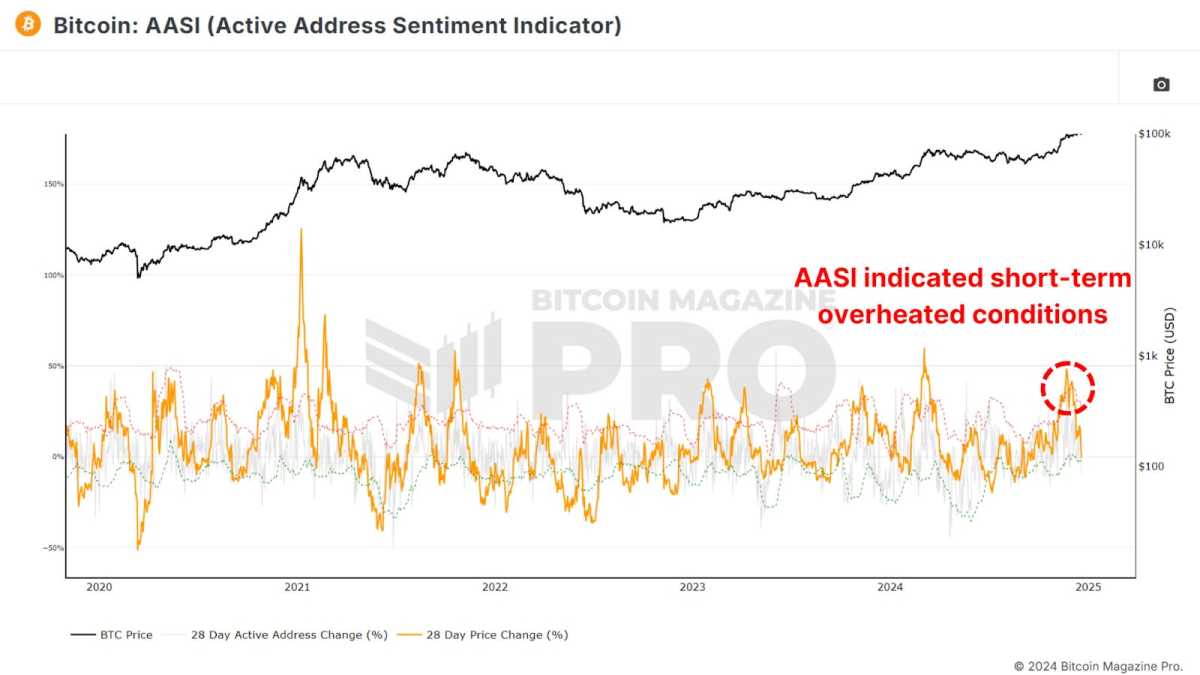

active address sense

This metric tracks 28-day percentage change in active network addresses along with price changes over the same period. When price growth outpaces network activity, it suggests that the market may be short-term overbought, as positive price action may not be sustainable given network usage.

View Live Chart

Recent data shows a slight cooldown after Bitcoin’s rapid climb from $50,000 to $100,000, indicating a healthy consolidation period. This pause is potentially setting the stage for sustained long-term growth and does not indicate that we should face a medium to long-term recession.

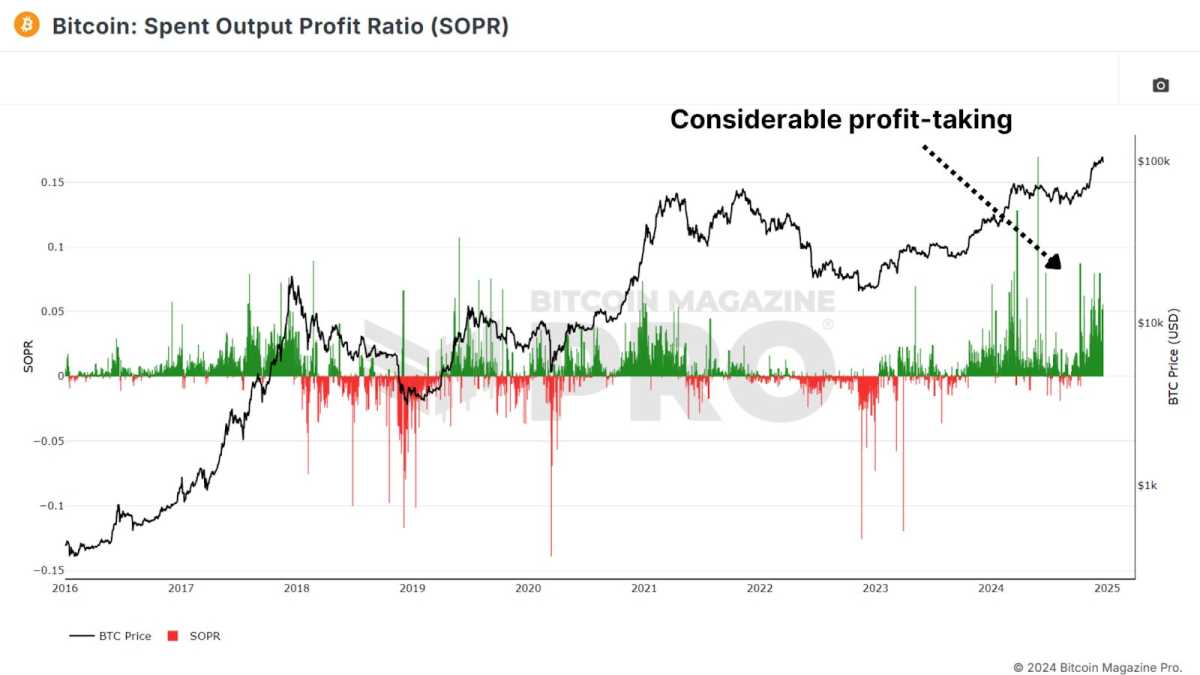

expense output profit ratio

Expense Output Profit Ratio (SOPR) The measures resulted in gains from Bitcoin transactions. Recent data shows that profit taking has increased, potentially indicating that we are entering the latter stages of the cycle.

View Live Chart

One caveat worth considering is the increasing use of Bitcoin ETFs and derivative products. Investors may shift from self-custody to ETFs for ease of use and tax benefits, which may impact SOPR values.

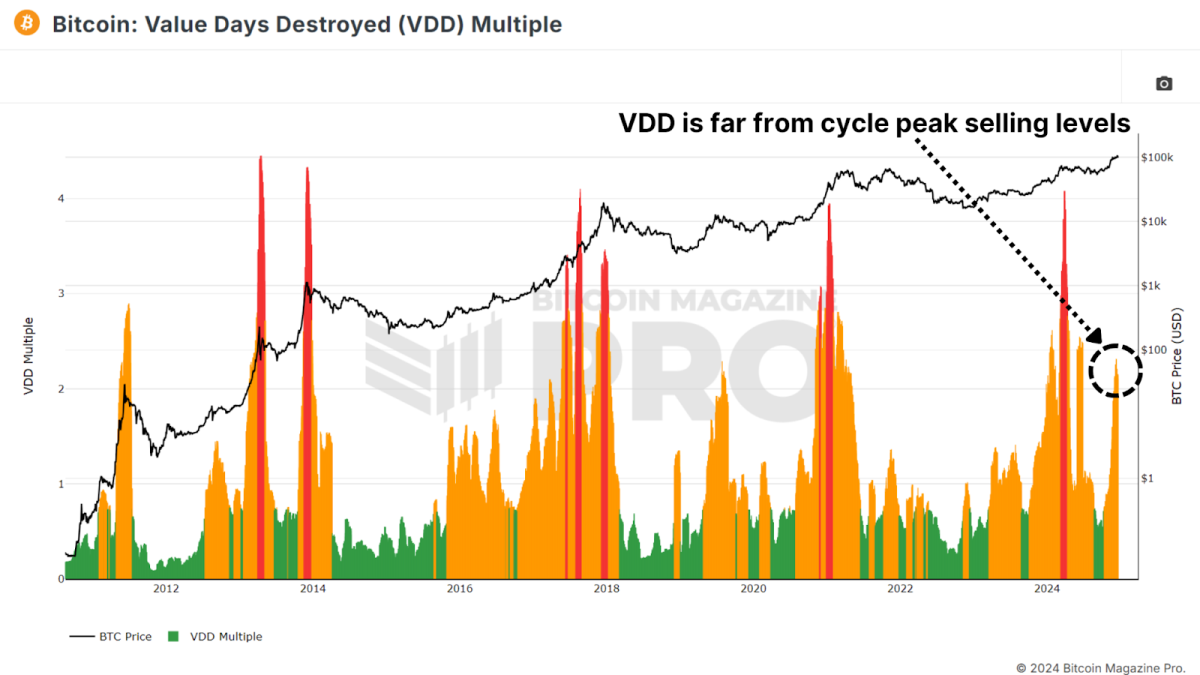

value days destroyed

Value Days Destroyed (VDD) Multiplier CDDs expand by placing the burden on large, long-term holders. When this metric enters extremely hot red territory, it often signals a major price peak as the market’s largest and most experienced participants begin to cash out.

View Live Chart

While Bitcoin’s current VDD level suggests a slightly overheated market, history suggests it could hold this range for months before peaking. For example, in 2017, the VDD indicated overbought conditions almost a year before the top of the cycle.

conclusion

Overall, these metrics suggest that Bitcoin is entering the latter phase of its bull run. While some indicators point to a short-term cooling or modest overgrowth, most highlight substantial growth through 2025. Key resistance levels for this cycle could emerge between $150,000 and $200,000, with metrics like SOPR and VDD providing clear signals as we approach the peak.

For a more in-depth look at this topic, watch a recent YouTube video here: What’s happening on-chain: Bitcoin updates

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your research before making any investment decision.