reason to believe

Strict editorial policy

Carefully reviewed by industry experts

The highest standard in reporting and publication

Strict editorial policy

Morbi Pratium Leo et Nisl Elikum Molis. Quisk Arcu Loram, Ultris Quis Palenttec NEC, Ulkmopper EU Odio.

Esteculo Tambinene Esta Disponible N Esponol.

On-chain data analytics firm Glasnod has identified a complicated change in retail investor preference, which spots the XRP as the focal point of betting interest. The conclusions from the new published report of Glasnod, called “Ripling Aay” suggest that bitcoin market indicators reach close to a recession area, XRP has seen the remarkable flow of capital and user activity – even if with signs of women’s speed.

Glasanode according to ReportBitcoin is integrated between $ 76,000 and $ 87,000 price limit. Indicators such as the realization of realization/loss ratio “close-term vendors are showing signs of exhaustion, but still not renewing the speed of continuous speed.”

In addition, a long-term chain-chain “Death-Cross” states that the current weakness of the market may persist for some time. The report states, “The supply increases at 4.7m BTC,” the report states, underlining the depth of stress, “the report states. These conditions in the form of Glasanode notes paint a picture of “deepening the recession position” for the major cryptocurrency.

Retail for XRP

Unlike the signs of caution of bitcoin, Glasnode indicates the XRP as a proxy for extended retail speculation to this cycle. The report stated: “In particular, for this cycle, Ripple (XRP) has been a preferred property for business among retail investors, and can study its behavior, therefore, retail can serve as a proxy to measure the speculative demand.”

Related reading

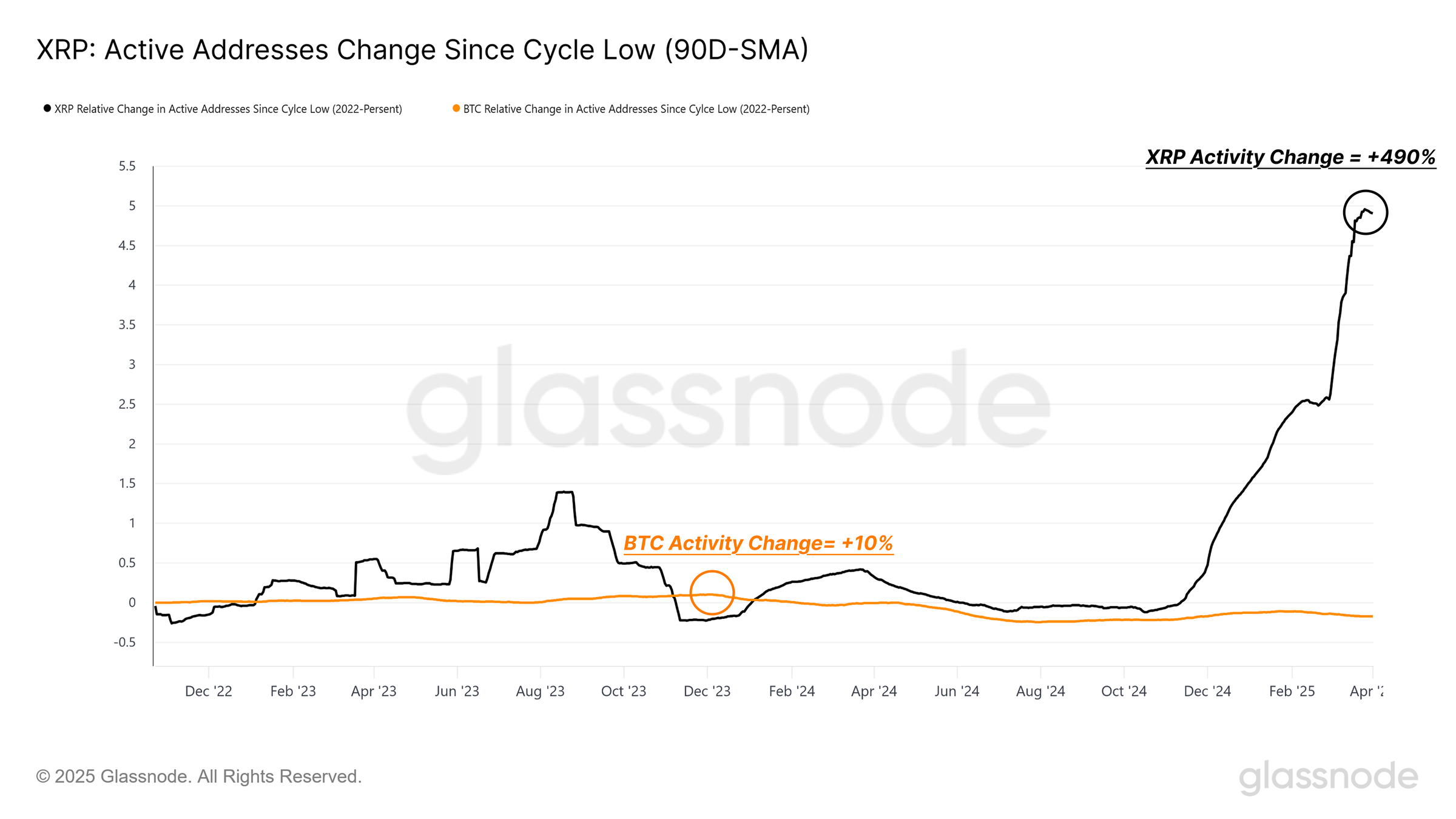

The 2022 cycle, low, the daily active address of the XRP “jumped by 490%on a quarterly average basis, while the bitcoin increased by only 10%. This sharp deviation outlines the excitement of the retail community for the XRP, which looks at the Glassnode market as a sign of widespread betting hunger.

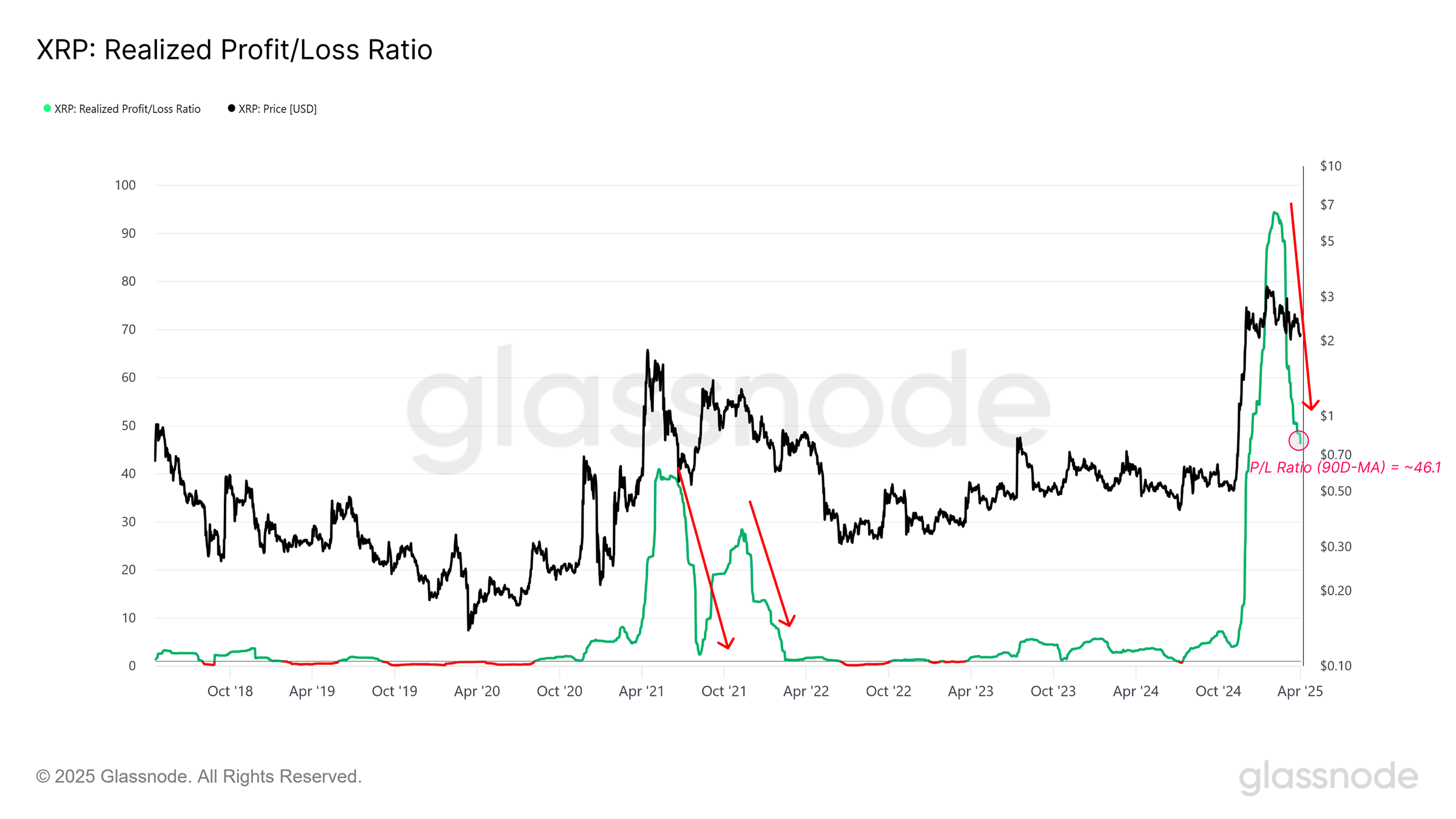

Enthusiasm for XRP translated into close-behavior of her realized hats-during its rally in early 2024 to 2025, from $ 30.1 billion to $ 64.2 billion, Glasode estimated that about 30 billion dollars of this new capital came in the last six months, which indicates a fresh wave of market participants.

With a low increase in capital flow, new investors have a rapid concentration of funds in the hands, “reports. However, Glasanode also warned:” When seen with heavy retail participation, this rapid uplift in new holders indicates caution. ,

Related reading

Glasanod has warned that these new investors are unsafe for instability below, especially the base of the cost of XRP becomes more top-thunder. Thus, despite the initial enthusiasm, the report makes a cool of speculative interest from the end of February 2025.

Glassnode feeling loss/profit ratio for XRP has come down continuously since January 2025, which suggests a slip in profitability and “reduces trust.” This can reflect a more delicate market structure, where large swaths of relatively new holders face the loss of growing paper.

The report stated, “The XRP market is showing symptoms of a top-intensive structure, with many investors caught on a relatively high cost.” In the event of XRP, this delicateness can also create widespread caution for retail altcoin markets.

Overall, the latest research of Glasnod underlines the dicotomy in today’s digital asset landscape. While the flow of bitcoin has increased damage to long -term holders below $ 80,000, the XRP’s meteorite growth and later recession reflect a market powered by short -term retail enthusiasm that can get closer to saturation.

“For more speculative assets such as XRP, the demand may be at the peak already,” the report has been concluded, “a precaution may be suggested until a strong recovery signs begin to emerge.”

At the press time, XRP traded at $ 2.00.

Image made with Dall.E, chart from traudingview.com