Bitcoin has historically followed a familiar four-year cycle. Now, two years into the current cycle, investors are closely watching patterns and market indicators for insight into what may happen over the next two years. This article highlights the structure of Bitcoin’s four-year cycle, past market behavior, and future prospects.

4 year cycle

Bitcoin’s four-year cycle is partially influenced by scheduled halving events, which reduce 50% of the block rewards miners receive every four years. This reduction reduces the supply of new Bitcoins entering the market, often creating supply-demand pressure that can push prices higher.

It can be clearly estimated that Stock-to-flow modelWhich compares the amount of BTC currently in circulation to its inflation rate, and creates a ‘fair value’ model based on comparable hard assets such as gold and silver.

Currently, we are in the middle of this cycle, which means we are potentially entering a period of exponential gains as halving progress is followed by the usual one-year catch-up phase.

A look at 2022

Two years ago, Bitcoin suffered a serious decline amid a series of corporate busts. FTX collapsed in November 2022, as rumors of bankruptcy triggered a massive selloff. The domino effect was brutal, as other crypto institutions like BlockFi, 3AC, Celsius, and Voyager Digital were also decimated.

The price of Bitcoin dropped from nearly $20,000 to $15,000, reflecting broader market jitters and investors worrying about Bitcoin’s survival. However, true to form, Bitcoin surged again, rising five times from the 2022 low. Investors who weathered the storm were rewarded, and this rally supports the argument that Bitcoin’s cyclical nature remains intact.

equal sentiment

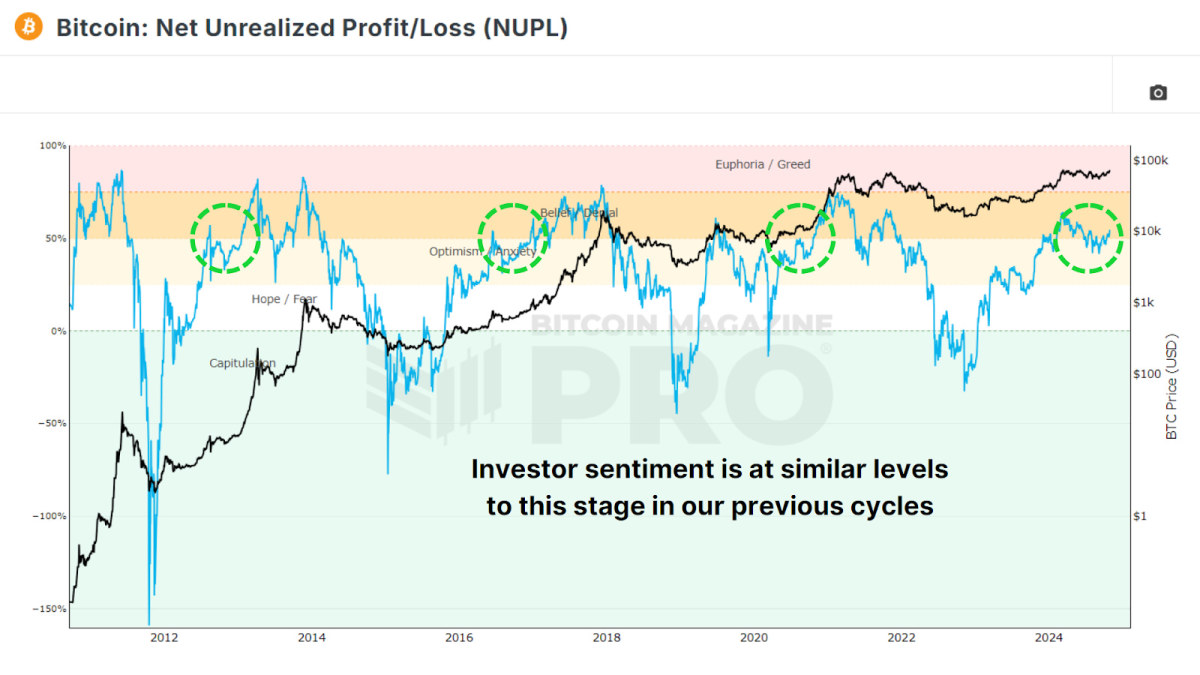

In addition to price patterns, investor sentiment also follows a predictable rhythm in each cycle. I am analyzing Net Unrealized Profit and Loss (NUPL)A metric showing unrealistic gains and losses in the market indicates that emotions such as excitement, fear and surrender are repeated regularly. Bitcoin investors typically experience intense feelings of fear or pessimism during each bear market, only to return to optimism and euphoria as prices recover and rise. Currently, we are entering the ‘confidence’ phase once again after our initial cycle runup and subsequent consolidation.

global liquidity cycle

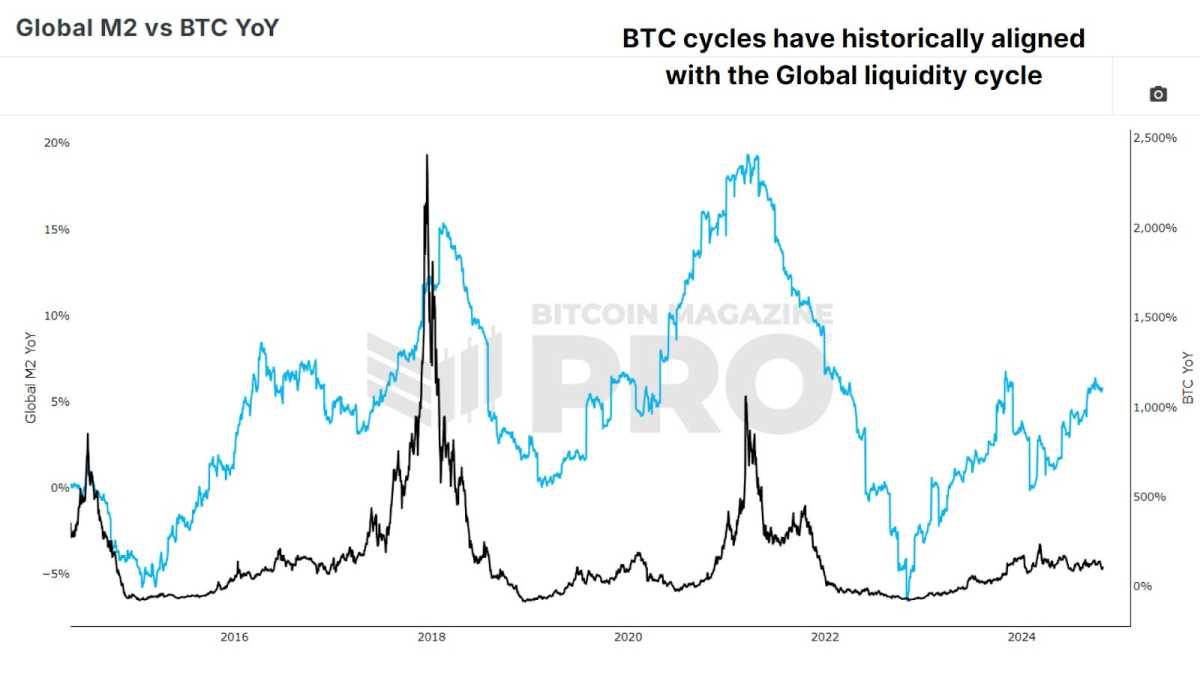

Global money supply and cyclical liquidity, as measured by Global M2 YTD vs BTCHas also followed a four-year cycle. For example, M2 liquidity hit lows in 2015 and 2018, just as Bitcoin hit lows. In 2022, M2 bottomed again, which aligned perfectly with Bitcoin’s bear market lows. Following these periods of economic contraction, we see fiscal expansion across central banks and governments everywhere, creating more favorable conditions for Bitcoin’s price to rise.

familiar patterns

Historical price analysis shows that Bitcoin’s current trajectory is very similar to previous cycles. From its low, Bitcoin usually takes around 24-26 months to surpass the previous high. The previous cycle took 26 months; In this cycle, the price of Bitcoin is in a uniform upward trend after 24 months. Bitcoin has peaked almost 35 months after its historical low. If this pattern holds, we could see significant price increases until October 2025, after which another bear market could set in.

After the anticipated peak, history suggests that Bitcoin will enter a bearish phase in 2026, which will last for about a year until the next cycle begins anew. These patterns are not a guarantee but provide a roadmap that Bitcoin has followed in previous cycles. They provide investors with a possible framework for predicting and adapting to the market.

conclusion

Despite the challenges, Bitcoin’s four-year cycle has persisted primarily due to its supply schedule, global liquidity and investor psychology. Thus, the four-year cycle remains a valuable tool for investors to interpret potential price movements in Bitcoin and our base case for the rest of this cycle. However, relying solely on this cycle may be short-sighted. By incorporating on-chain metrics, liquidity analysis and real-time investor sentiment, data-driven approaches can help investors respond effectively to changing conditions.

For a more in-depth look at this topic, watch this recent YouTube video here: 4 Year Bitcoin Cycle – Halfway Done?