The price movement of bitcoin has always been a matter of debate between investors and analysts. With the return of the market recently, there are many questions whether bitcoin has already reached its peak in this bull cycle. This article examines data and on-chant matrix to assess the market status of bitcoin and potential future movements.

For deep complete analysis, see the original Is the price of bitcoin already at its peak? Available on full video presentation Bitcoin magazine proYouTube channel.

Current market performance of bitcoin

Bitcoin recently faced its all -time high to 10% retracement, causing concern about the end of the bull market. However, historical trends suggest that such improvements are common in a bull cycle. Typically, bitcoin experiences pullbacks from 20% to 40% to 40% before reaching its final cycle peak.

Analysis of on-chain matrix

MVRV z-score

MVRV z-scoreWhich measures the market value to the actual value, currently indicates that bitcoin still has considerable reverse capacity. Historically, the cycle of bitcoin is at the top when it enters the metric overdated red zone, which is not the case currently.

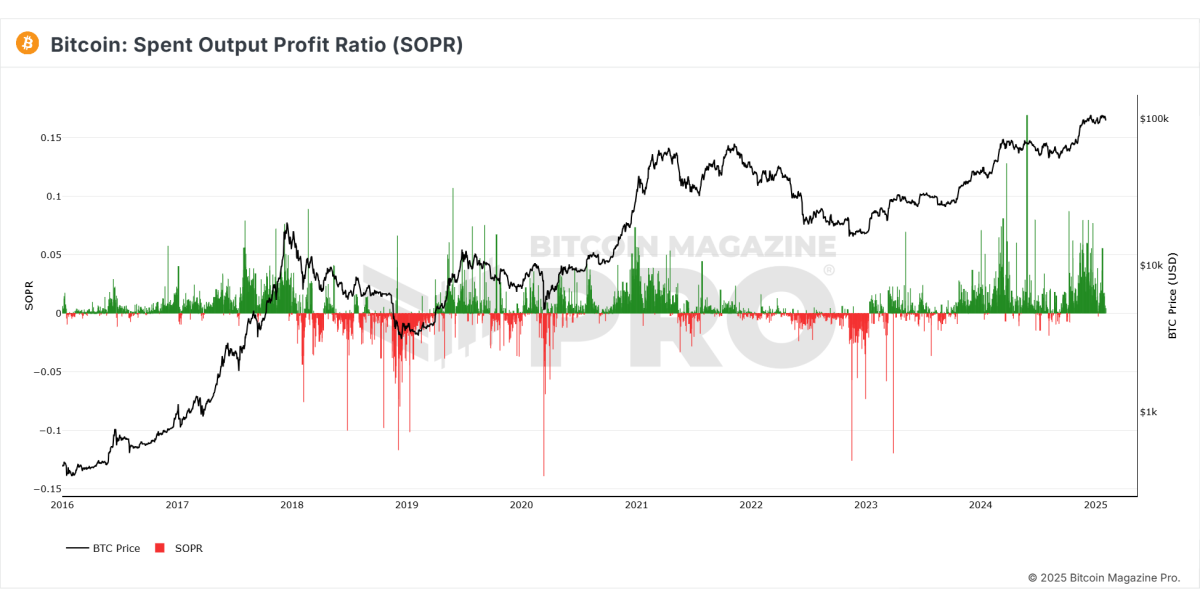

Spending production ratio (sopr)

This reveals the ratio of the output spent in metric benefits. recently, Soap It has been shown that profits have declined, suggesting that fewer investors are selling their holdings, strengthening the stability of the market.

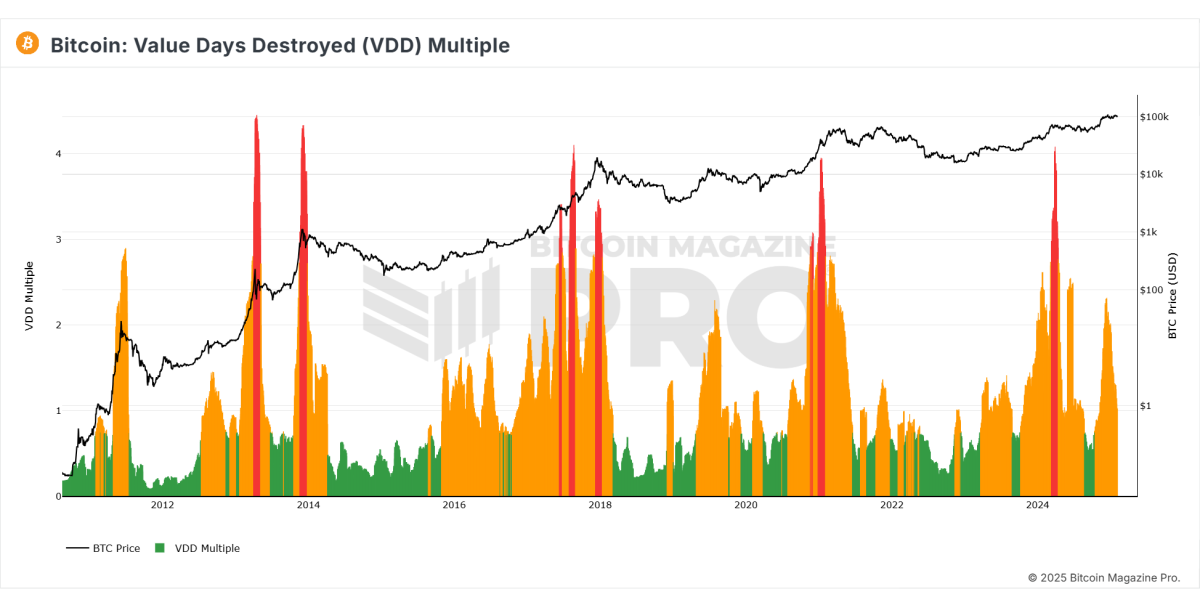

Destroyed day (VDD)

Videid Prolonged the sale of holders. The metric has shown a decline in selling pressure, suggesting that bitcoin is stabilizing at a higher level rather than going down for a long time.

Institutional and market spirit

- Institutional investors, such as microstrati keeps collecting bitcoins, indicate confidence in its long -term value.

- The spirit of the derivative market has become negative, historically a potential short-term value indicates below as the high-level traders who betting against bitcoin may be liquid.

Paralya -Economic Factor

- Quantitative Tighten: Central banks are reducing liquidity, contributing to the decline in temporary bitcoin value.

- Global M2 Money Money Supply: A contraction in money supply has affected risk assets, including bitcoins.

- Federal Reserve Policy: There are signs of major financial institutions, including JP Morgan, which can return to quantitative ease of 2025, promoting the value of bitcoin.

Related: Is $ 200,000 a realistic bitcoin price target for this cycle?

Future approach

- The price action of bitcoin is showing signs of entering a consolidation phase before another possible rally.

- On-chain data shows that the cycle seen in the previous bull markets is still important for development before reaching the peaks.

- If bitcoin experiences moving forward to a range of $ 92,000, it can offer a strong accumulation opportunity for long -term investors.

conclusion

While Bitcoin has experienced a temporary retracement, on-chain metrics and historical data suggest that the bull cycle is not over yet. The institutional interest remains strong, and the macroeconomic position may move to the side of the bitcoin. As usual, investors should carefully analyze the data and consider long -term trends before making any investment decisions.

If you are interested in more depth analysis and real -time data, consider checking Bitcoin magazine pro For valuable insight into the bitcoin market.

Disclaimer: This article is only for informative purposes and should not be considered financial advice. Always do your own research before making any investment decision.