It may be controversial to discuss when and how to sell bitcoin, but if you are planning to take advantage of this cycle, it is necessary to do it strategically. Catching bitcoin indefinitely is an option for some, the purpose of many investors is to catch the profit, cover the living expenses, or reinstate the low prices. Historical trends suggest that bitcoin often experiences a drawdown of 70–80%, giving opportunities to reuse in low evaluation.

To watch more deeply on this subject, watch youtube videos recently: Bitcoin price proven strategy to sell peak

Why selling is not always forbidden

While some, like Michael Siler, the lawyer never sells bitcoins, this stance does not always suit individual investors. For those who do not manage billions, taking partial advantage can lead to flexibility and peace of mind. If there is a peak of bitcoin, it is said, $ 250,000 and a fairly conservative face 60% improvement, it will revaluate $ 100,000, making us a chance to re -establish the lower levels than already seen Will produce

The goal is not to sell everything, but strategically scal out of positions, maximize returns and manage risks. It requires practical, data-powered decisions to achieve this, not emotional reactions. But then, if you never want to sell, not! Whatever works best for you.

Major time equipment

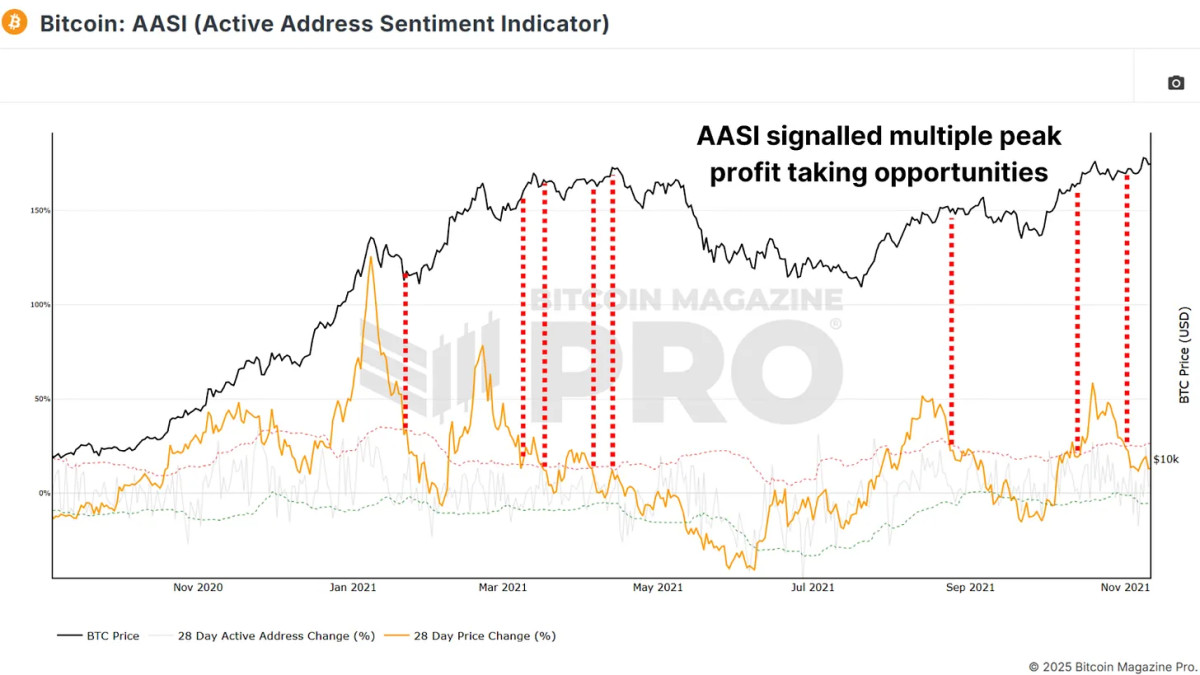

it Active address emotional (AASI) The value of bitcoin compares changes in network activity in movement. This measures the deviation between the price (orange line) and network activity shown by the green and red deviation band.

View live chart

For example, during the 2021 bull run, the signs came out when the price change exceeded the red band. Cell signals appeared in $ 40,000, $ 52,000, $ 58,000 and $ 63,000. Each provided an opportunity to heat the market.

Fear and greed index A simple is yet effective emotion tool that determines the amount of market enthusiasm or nervousness. Values above 90 suggest extreme greed, often preceding reforms, such as 2021, when bitcoin rallied from $ 3,000 to $ 14,000, the index hits 95, indicating a local peak.

View live chart

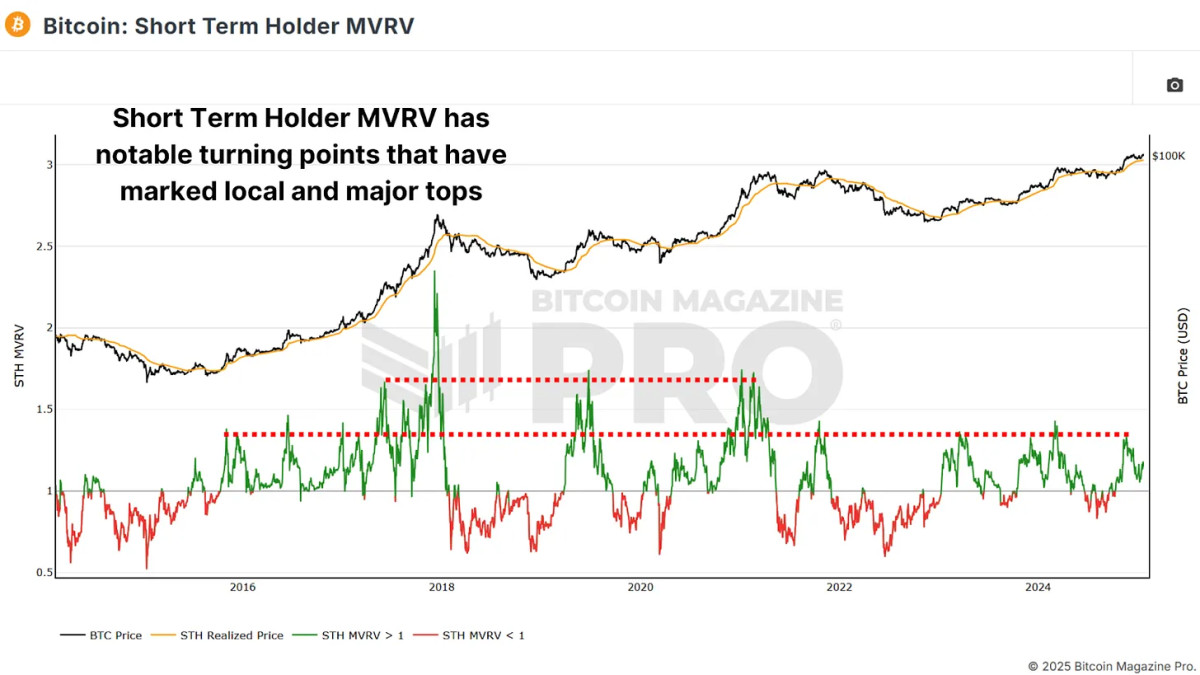

Short -term holder mVRV Comparing their cost base to current prices measures the average unrealistic profit or loss of new market participants. The level of approximately 33% profit often marks reversal and local intracellic peaks, and when the untrue profit is more than about 66%, the markets are often warm and may be close to the major cycle peaks.

View live chart

Related: bitcoin deep dive data analysis and on-chain roundup

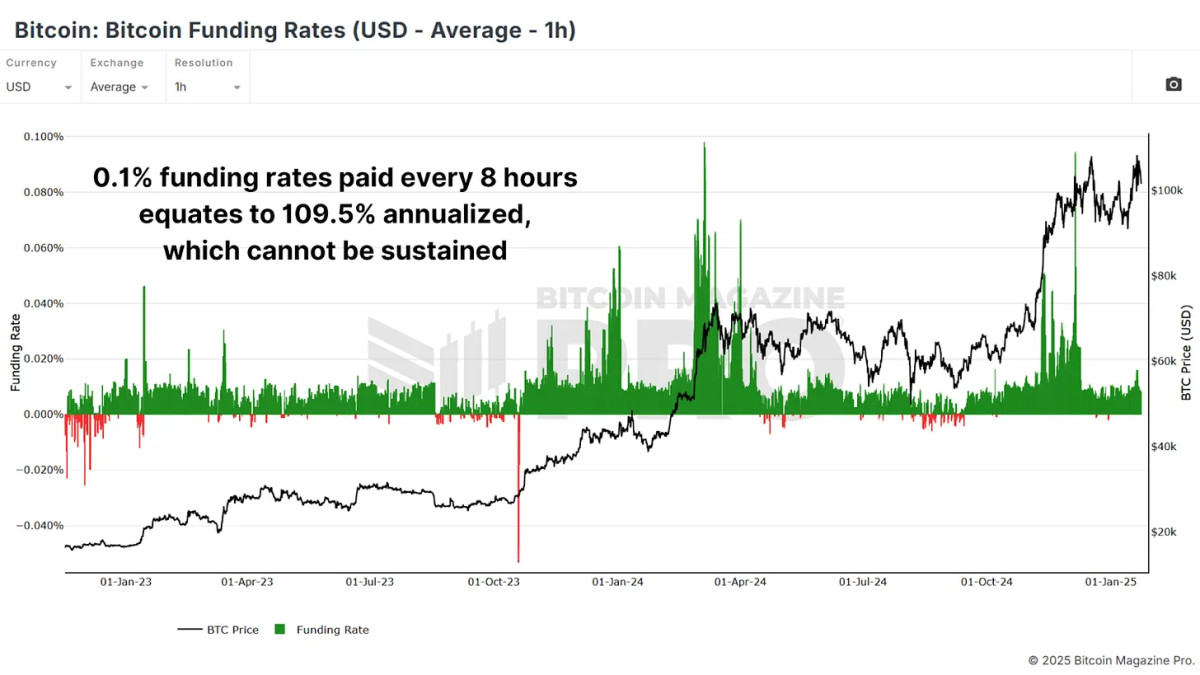

Bitcoin Finance rates Pay premium traders to maintain leverage positions in futures markets. The highly high amount of money rate suggests excessive speed, often before improvements. Like most metrics, we can see that counter-trading usually provides an edge.

View live chart

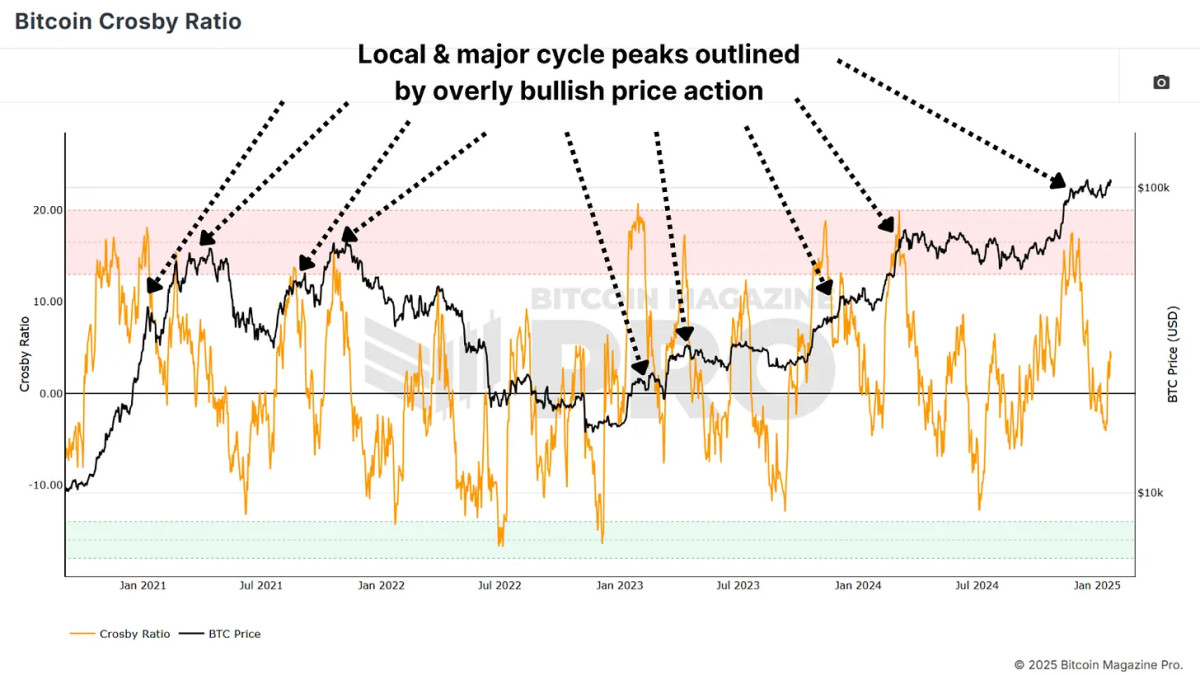

Crossbee Ratio There is a motion-based indicator that highlights overheat conditions. When the ratio enters the red zone on the daily chart, or even less timeframe if you use our tradingview version of the indicator, the market turning point is usually occurred. When these signals are in the confluence with other top-identified matrix, it strengthens the possibility of a large-scale prediction.

View live chart

conclusion

The exact top time is almost impossible, and no metric or strategy is silly. Mix several indicators to the confluence and avoid selling your entire position at a time. Instead, scale out in increment as the major indicator indicates overs -overheated conditions, and when the price rallies are higher, the excess benefits are tied to the main levels or a percentage of the price movement to capture the additional benefits. Consider.

See for more detailed bitcoin analysis and to reach advanced facilities like live charts, personal indicators alert and in-depth industry reports, Bitcoin magazine pro,

Disclaimer: This article is only for informative purposes and should not be considered financial advice. Always do your own research before making any investment decision.