reason to believe

Strict editorial policy

Carefully reviewed by industry experts

The highest standard in reporting and publication

Strict editorial policy

Morbi Pratium Leo et Nisl Elikum Molis. Quisk Arcu Loram, Ultris Quis Palenttec NEC, Ulkmopper EU Odio.

Esteculo Tambinene Esta Disponible N Esponol.

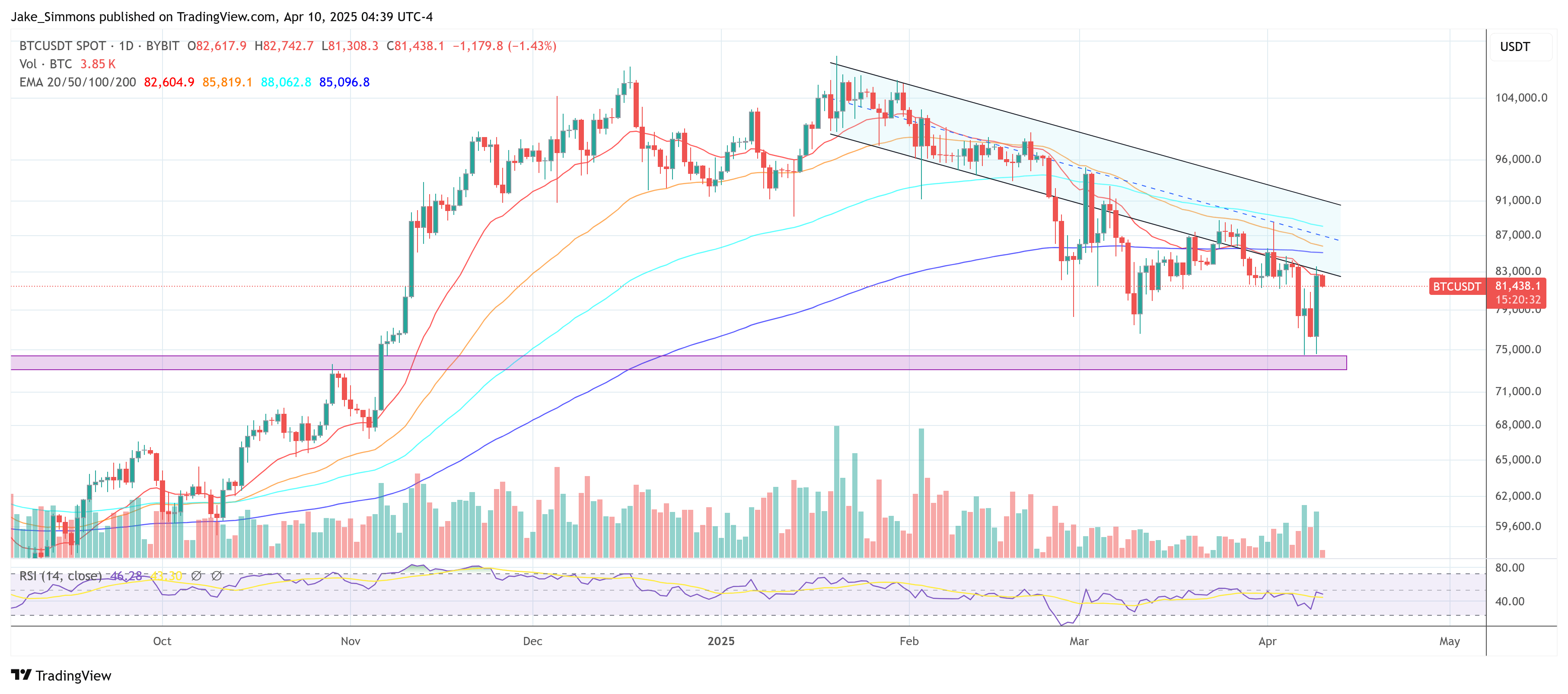

On Wednesday, Bitcoin increased by more than 8% to reach $ 83,588, which was announced by President Donald Trump after the announcement of a 90-day break on new mutual tariffs for more than 75 countries except China. Investors and market analysts saw the move as a sign of relief, showing that the rapid growth of tariffs would be minimized at least temporarily. Nevertheless, President Trump simultaneously increased the tariff rate on China by 125%, showing that the trade fight between the world’s two largest economies has settled.

Trump’s decision to stop most of its newly declared tariffs was bound to worry about disruptive changes in the bond market. The yield on 10 -year Treasury notes, which had increased to a height of seven weeks, became elevated after the tariff came to the fore. Despite temporary relief for many countries, immediate tariff growth on China highlighted the ongoing deadlock, suggesting frequent uncertainty for global markets. Some analysts saw the bounce of risk assets, including bitcoins, as partially operated by changing expectations around future talks.

Potential China deal is not the price for bitcoin

Between this background, which McCain, Founder, CEO, CIO, and Solo Managing GP of the Crypto Fund asymmetric, Echoing His approach to X, given that the market was originally pricing in tariffs for China, the European Union and the whole world, but now only China is pricing.

Related reading

He indicated that a deal with Beijing remains unhappy, so if any success emerges, the market “explosion”. “The market price was being targeted by China, the European Union and all others. The market was now pricing only China. The market is not paying the price of a China deal,” McCain commented.

He also notes that “long -term explosions at the end have been blowing the risk equality pods,” referring to sudden market movements in long -term bonds. The McCan is reminiscent of the market floor during the Covid period, in which the fund again begins to cover the gross position and small-sellers. He highlights the possibility that if the yuan is stronger than the dollar, it would mean that China is ready to negotiate, meaning that equity and crypto markets can do very little business.

“But today, only the funds have increased again and shorts covered for a long time. Trump has indicated maximum pain for China and is ready to negotiate. The market can only go to the price again. If the yuan rallies are compared to the dollar tonight, it is probably an indication that China wants to talk, which means that the market is very low.

“Not yet out of the forest”

Head of Alpha Strategies on Jeff Park, Bitwaiz, Wags This environment remains delicate, the X note that the yuan weakens dynamics, a 10 -year iconic yield above 4%, and the credits running beyond 400 base points remain as potential headwinds. According to him, “[this] Will be an unpopular opinion […] We are still out of the forest […] Pure results are still negative to risk assets, “especially if the Federal Reserve does not cut rates first.

Related reading

He quoted this lack of monetary support as a factor that enhances instability. “If anything is actually more than the fact that the liquidity in the market is to experience casino swing,” he writes through X.

X user Adam Yoder agrees that “Bonds have increased even today, gold has gone up,” suggesting that traditional investors still have sufficient-safe-flow flows to keep careful with risky assets. The park said, “This is really a terrible step” and confusing what the White House expects to achieve with a partial break, which leaves China alone.

Meanwhile, your earlier call, in a sharp reversal of Goldman Sachs carry back After confirmation of 90-day stoppage, the basis of recession declared recently. Its revised approach published by Jan Hatzius suggests that the total tariffs are still applied to the existing area-specific rates of the existing 10% and 25%, but that the market is immediately increased globally.

Goldman now cuts its previous non-market baseline forecast of 0.5% Q4/Q4 GDP in 2025, the possibility of 45% recession, and in three gradual 25-base-point “insurance” by the Federal Reserve in June, July and September. According to the statement, “We continue to expect additional sector-specific tariffs” and a holistic rate that Goldman initially approached from a 15 percent increase.

Everyone’s eyes on today’s CPI release

In particular, today, the US Consumer Price Index (CPI) data for March 2025 is to be released by the US Bureau of Labor Statistics (BLS) at 8:30 ET – a large report for the market that may be important for the next step of BTC.

For February 2025, the CPI saw an increase of a year-on-year (Yoy) 2.8% (not seasonally), with an increase of 0.2% (MOM) more than a month (MOM) (MOM) (MOM). The core CPI, except for food and energy, was 3.1% yoy. It marked a minor cooling at the 3.0% yoy headline rate of January, suggesting a gradual disruption trend.

Expectations for March CPI potentially falls to about 2.5% yoy, some analysts suggest that it may fall by 2.6% or less if the trend in housing costs, rent and energy prices is decreasing. The core CPI is estimated to hover about 3.0% to 3.1% yoy, reflecting continuous pressure from services and shelter costs.

At the press time, BTC traded at $ 81,438.

Image made with Dall.E, chart from traudingview.com