Okay, okay, okay—if it’s not Jack Mellors dropping truth bombs like they’re going out of fashion! His latest video on the Bitcoin shortage has me more excited than the Brit who found out the pubs are opening early.

You see, we Brits have a habit of mincing words, but when it comes to Bitcoin, subtlety takes a back seat. We often talk about Bitcoin as an inflation hedge – as if it’s some kind of financial umbrella protecting us from the monetary drizzle. But let’s cut the crumpets; The real magic lies in its limited supply.

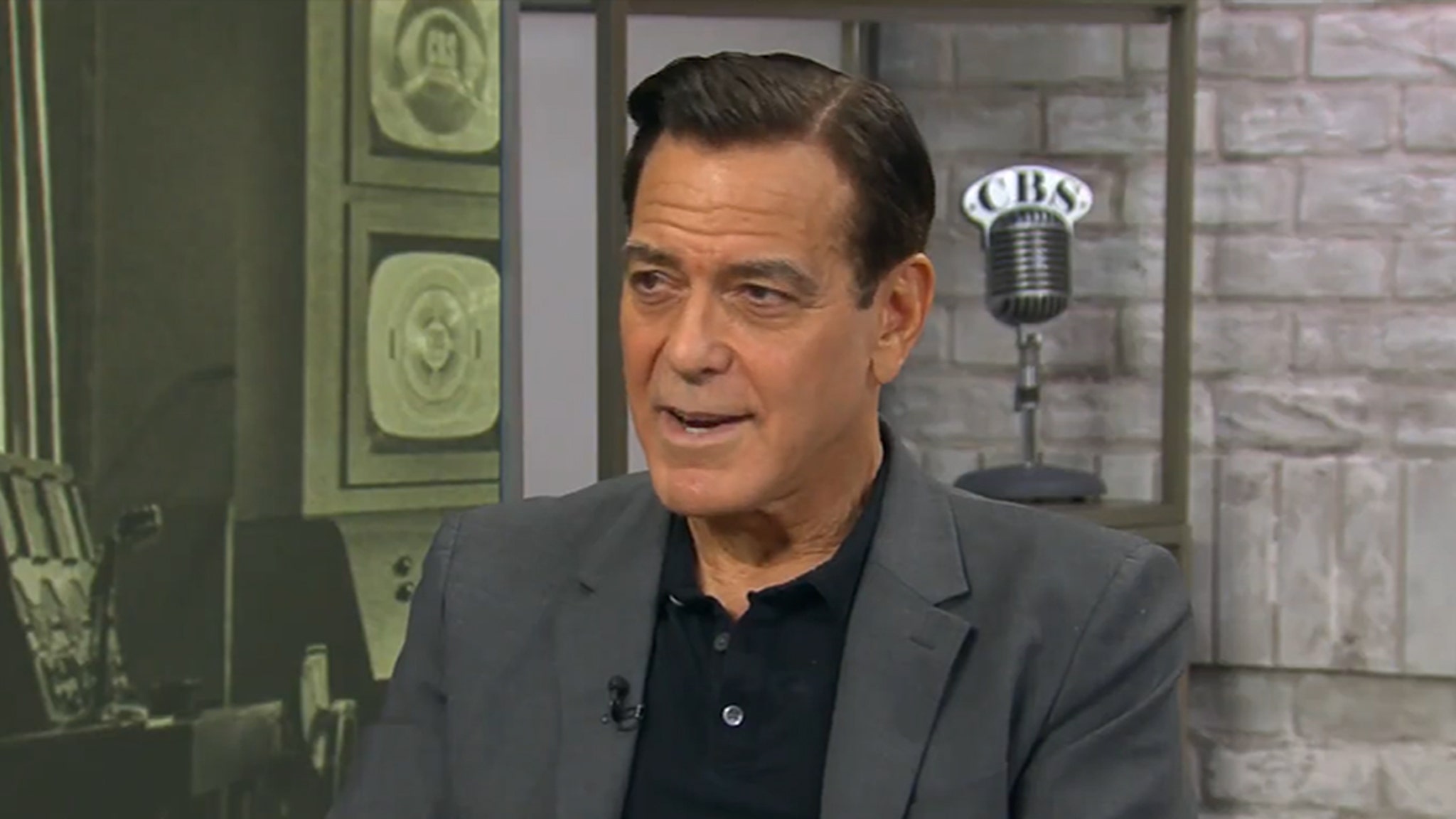

in his recent episode The Money Matters PodcastStreamed live on 11 November 2024, Mallers didn’t just hit the nail on the head; He used a sledgehammer. “Bitcoin is a solution, it is not a rescue,” he declared, with the kind of conviction you would expect from someone who has just discovered tea and biscuits.

He pointed out the clearly obvious – yet often overlooked – fact that Bitcoin is the only asset where increased demand does not outpace supply. If everyone suddenly wants an iPhone, Apple will churn them out faster than what they call “planned obsolescence.” But if everyone wants Bitcoin? Nice, hard biscuits. There’s a certain supply, and that’s it.

“Bitcoin is the top-performing asset in the world because it is the world’s most scarce asset. It is the only asset that demands a higher price for more supply,” Mollers said candidly. It’s like trying to get tickets to a sold-out Oasis concert; The more you want them, the more you have to cough.

He also took a dig at those who think Bitcoin is just another part of the financial machine, related to stocks or precious metals. It seems as if he is telling us that while the world is fiddling with monetary policies like a cat with a ball of yarn, Bitcoin is standing firm.

Now, I don’t know about you, but the idea that Bitcoin is immune to the whims of central banks and governments makes me sleep better at night. Well, that and a good cup of Earl Grey. The finite nature of Bitcoin means it cannot be diluted, devalued or tampered with – contrary to my neighbor’s opinion on his lawn gnome.

Mallers put it brilliantly: “Bitcoin can change the world because the world can’t change Bitcoin.” It’s the financial equivalent of the unstoppable power you get from an immovable commodity – except that, in this case, the commodity is a decentralized account, and the force is our collective realization that scarcity is valuable.

So, what’s the takeaway here? If you’re still treating Bitcoin like an optional side dish rather than the main course, it’s time to rethink your financial menu. Bitcoin shortage is not a problem; This is a feature – rather a cool feature.

In the grand tapestry of assets, Bitcoin is that elusive thread of gold that doesn’t tarnish, doesn’t wear out, and certainly doesn’t grow just because we want something a little more shiny. It is now time that we recognize Bitcoin not only as a hedge against inflation but also as a standalone solution to the age-old problem of value preservation.

As for me, I have decided to value two things most: my time and my Bitcoins. Everything else is just window dressing – or, as we say across the pond, mere fluff.

So Jack Mellors is here to remind us that sometimes, less really is more. And if you haven’t seen his latest video, do yourself a favor and check it out. Just be prepared—you may find yourself nodding even harder than bouncing on the bumpy road.

to encourage!

watch the video:

#bitcoin Can change the world because the world can’t change #bitcoin pic.twitter.com/3WnamG8nL7

– Jack Mallers (@jackmallers) 14 November 2024

This article is a TakeThe opinions expressed are solely those of the author and do not necessarily reflect the opinions of BTC Inc. or Bitcoin Magazine.