It is the latest installment of a global news series called ‘On the Brink’, which profiles those who are struggling with the rising cost of life. In this story, a simple Ontario family talks about its struggles.

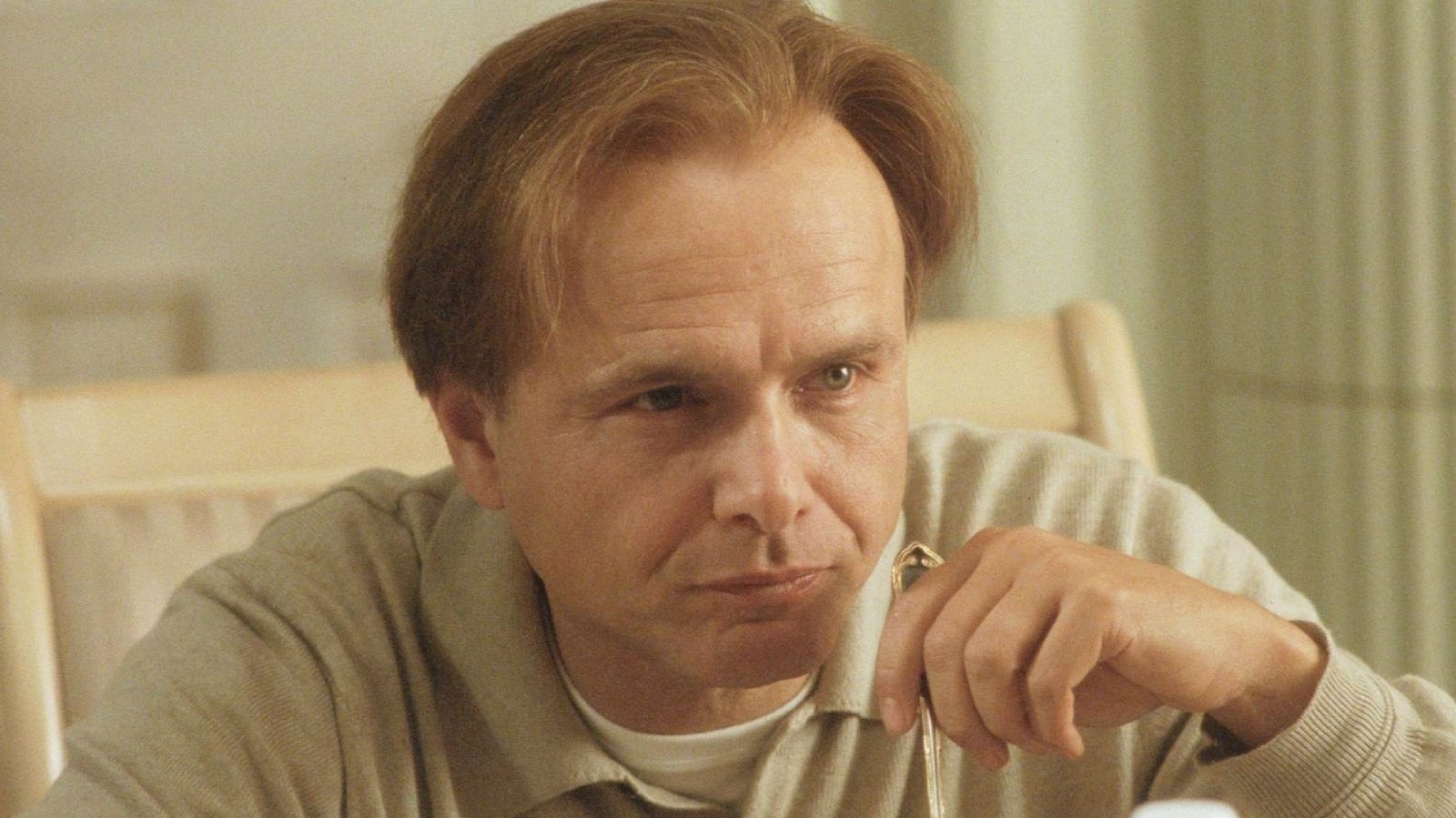

These days, Cheyene Alan says that his family should count every dollar that he has.

34 -year -old event planner and soon the mother of two from London, Onts. 20 years ago, he says, he is the owner of a house and staying away from two income will be stable.

But since the Kovid -19 epidemic, things have changed.

“I spent a lot of time working in two part -time jobs and going to school in my 20s, and I was just making it,” she told Global News.

“Now I am in my career, my husband has his own career, he bought this house in 2019, and we were doing well, and then the epidemic hit.”

It is used for ‘as far as it does not go’

Alan said that she and her husband, a bilmaker, bring about $ 147,000 a year before taxes. With that income, he feels that they should have more opportunities to get better.

Alan said, “As far as it does not go. It just does not.”

This situation is not unique to Allen and his family.

Moshe Lander, a professor at an economics at the University of Concorda, said that in the last five years, the purchase power of Canadian people has seen a noticeable decline.

However, it has been steadily decreasing since the 1980s.

Lander used McDonald’s Big Mac as an example.

“If you earn $ 20 per hour and a large Mac cost around $ 7, you are working for an hour for three big Macs. If, in the past, in the past, you were working for two big Mac in an hour, then it really does not really make any difference of how many dollars you were earning; your purchasing power has increased because you can buy big Mac with one hour of time,” they said.

“What has happened then, essentially, Big Mac prices have increased faster than the dollar volume, which we have earned in our job, so the number of big Mac we can buy has fallen.”

With the cost of living and an increase in the cost of a growing family, Alan stated that they insist on where each dollar is going.

The couple pays around $ 2,000 per month for a hostage, but they also have condo fees that are moving up.

Whereas now at a reasonable low rate, Alan said that he is concerned about his mortgage coming for renewal in two years, at the same time when his maternity leave will end for his second child.

“This is a way scary because when I have to go back to work and look at the cost of health care for two children, and it is difficult,” he said.

Cost of raising a family

At the age of one and a half years and with each other on the way, Alan said the cost could quickly connect.

“I was lucky enough to be able to nurse my child, so I hope I will be able to do so with the other because the formula of the formula is shaking,” Alan said.

The baby formula, with a cost of approximately $ 50 per week, said that it decides some families what the bill is to pay and feed their child.

While Alan tries to find deals, he said that it can be difficult to find the objects of good quality baby, even by the other hand, it is felt through everything.

His daughter is currently in a decar part -time, $ 600 per month, but if she was full -time, the cost would be $ 1,000 per month.

While she tried to bring her daughter into a list for a $ 10-day childcare spot, when she was five months pregnant, about two years later, she has not yet listened back.

Alan is worried about what will happen when she returns to work after her maternity leave is over.

“It seems that we are just one bill away from paying to go back to work. If we do not hear one from one of the day of $ 10-day, we have to see our options seriously,” he said.

Food prices are likely to rise in Canada: Report

The 15th annual food price report released by partnership of four Canadian universities in December 2024 predicts that in 2025, food prices will increase by three to five percent.

The report states that the average family of four expects to spend $ 16,833.67 on food in 2025, growth from 2024 to $ 801.56.

The report found that food power is a major concern for Canadian people.

This is a concern shared by Allen, which thinks that the prices of essential commodities must be better controlled.

Elon said that his family has started a kind of food gardening and protection to combat the cost of food, but with the influence of the US trade war, she is considering expanding her garden.

“People need food to live, people need water to live,” Alan said.

“And I think it is a bit forced to pay $ 6 for a small pint of blueberry.”

The fourth story of Global News ‘Readed on Brink Series’ is set to publish next Saturday.

If you have a story about the cost of living, you want to tell, please email us below.