Bitcoin’s 2025 trip has not expected the explosive bull market Serge. After moving up to $ 100,000, the price of 2025 bitcoins decreased rapidly as $ 75,000, instigating the debate among investors and analysts, where we are standing in the bitcoin cycle. In this analysis, we cut through noise, take advantage of on-chain indicators and macro data, to determine whether the bitcoin bull market intact or if Q3 2025 has a deep bitcoin correction. MVRV provides significant insight into the market such as Z-score, Value Days (VDD), and bitcoin capital flow.

Is 2025 pullback healthy or bull cycle end of bitcoin?

The 2025 bitcoin cycle is a strong starting point to assess the cycle MVRV z-scoreA reliable on-chain indicator compared to the feeling value compared to the market value. After hitting 3.36 at the peak of $ 100,000 of bitcoin, MVRV Z-score fell to 1.43, aligning from $ 100,000 to $ 75,000 with a fall in 2025 bitcoin price. This 30% bitcoin improvement may look dangerous, but the recent figures have shown MVRV Z-score rebounding from a low of 1.43 of 2025.

Historically, around 1.43 MVRV Z-score levels have marked local bottles, not in the tops, in pre-bitcoin bull markets (eg, 2017 and 2021). These bitcoin pullbacks often resumed uptrends launched, which align the current improvement with healthy bull cycle mobility. While the investor’s confidence is shaken, this step fit the historical pattern of bitcoin market cycles.

Smart Money 2025 Bitcoin shapes bull market

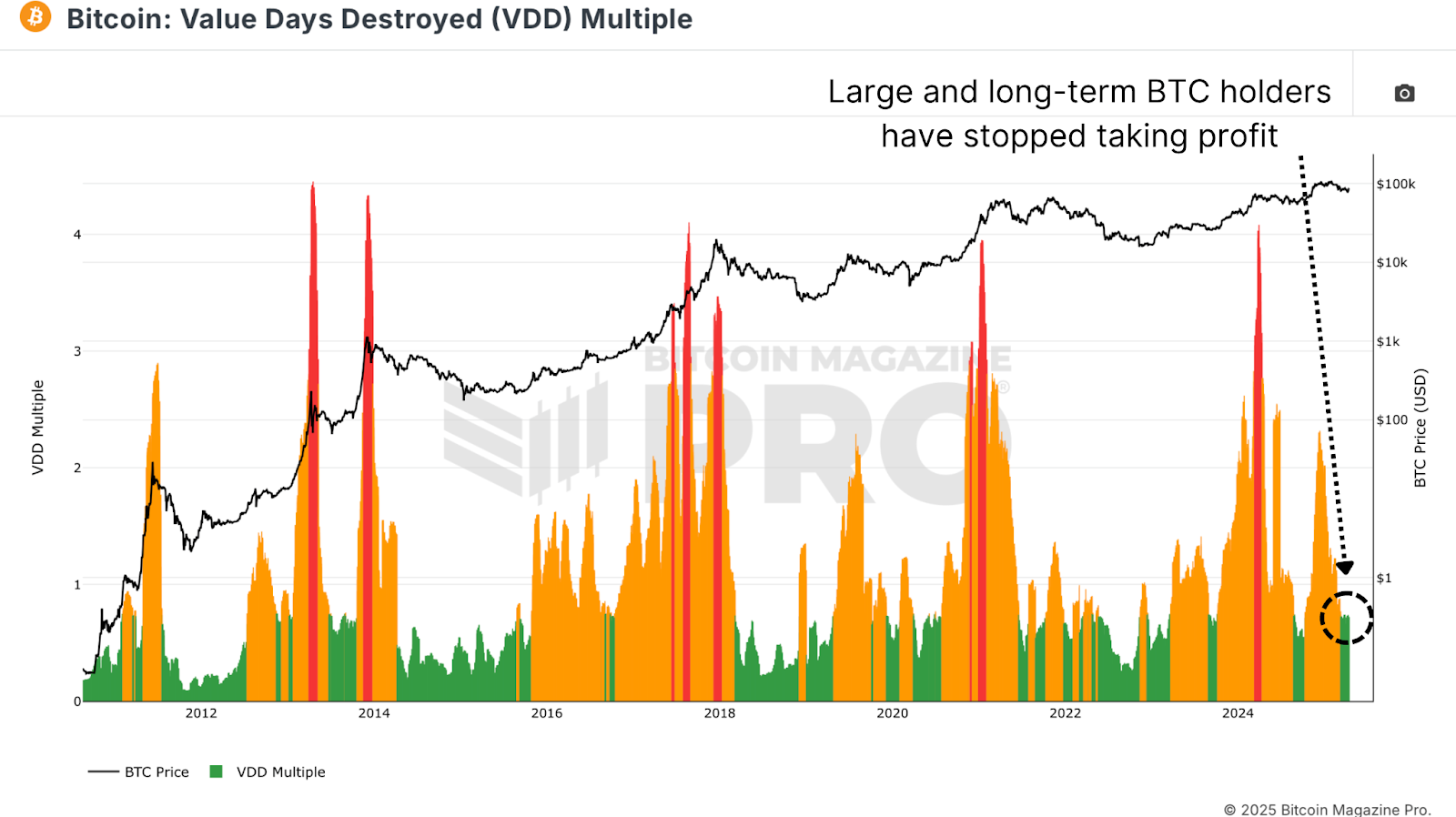

Price day destroy (VDD) manyAnother important on-chain indicator, tracks the velocity of BTC transactions weighed by periods. Spikes in taking VDD signal advantage by experienced holders, while low levels indicate bitcoin accumulation. Currently, the VDD is in the “Green Zone”, the mirroring levels seen in late beer markets or early bull market recovery.

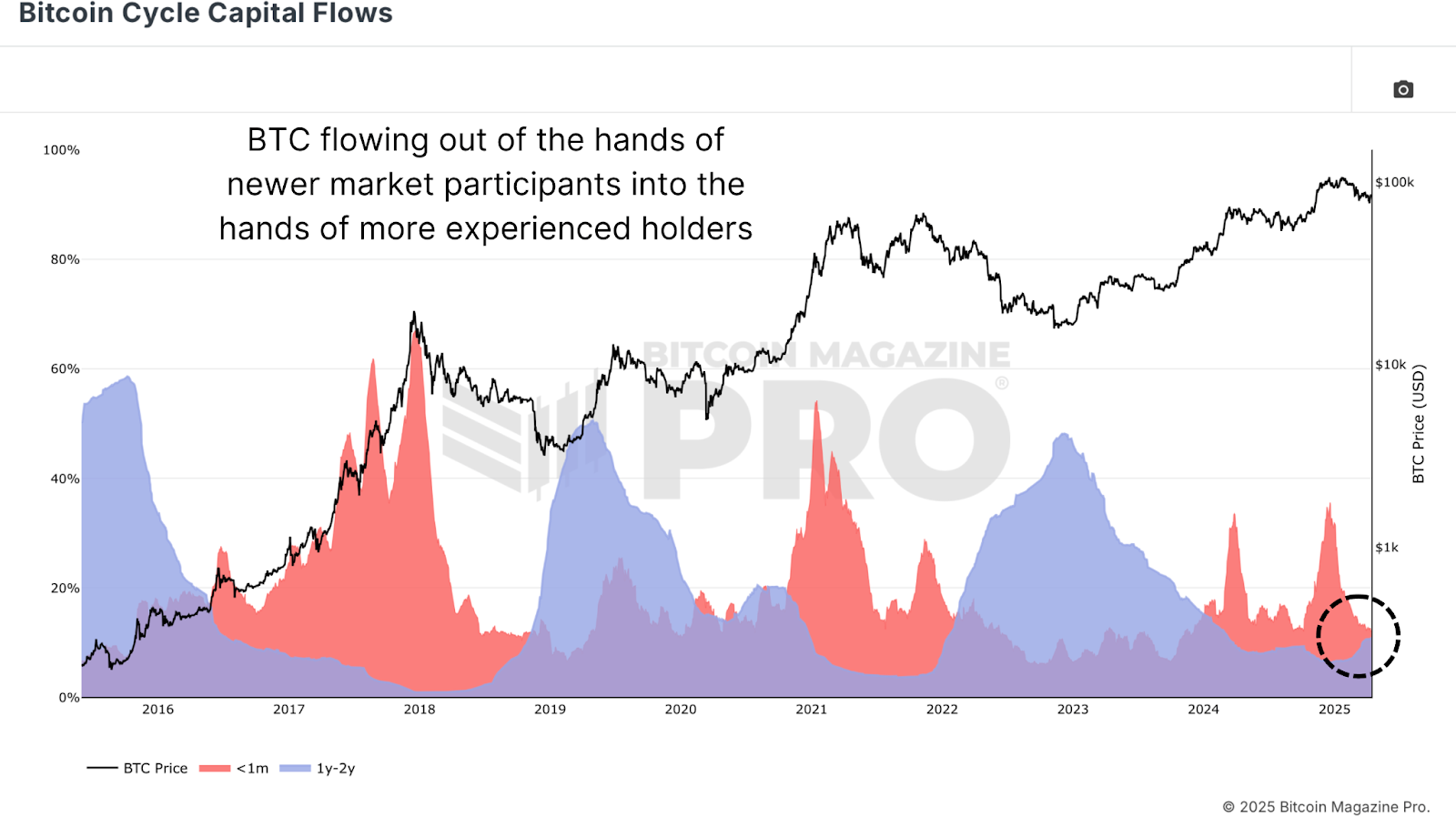

After the $ 100,000 is reversed by bitcoin, the low Vided suggested the end of a profitable phase, with longer holders accumulate in anticipation of high 2025 bitcoin prices. Bitcoin cycle capital flow The chart further illuminates this trend, breaking the capital realized from the age of the coin. Near the $ 106,000 peak, new market entry (<1 month) ran a spike in the activity indicating fomo-driven purchase. Since bitcoin pullbacks, the activity of this group has cooled down to specific levels of the initial-to-middle bull markets.

In contrast, 1-2 year-old Macro-loving bitcoin investor-activity increases, accumulates at low prices. This shift reflects bitcoin accumulation patterns from 2020 and 2021, where long -term holders bought during Dips, installed the platform for bull cycle rallies.

Where are we in the 2025 bitcoin market cycle?

Zoom out, bitcoin market cycle can be divided into three stages:

- Bear phase: deep bitcoin improvement of 70–90%.

- Recovery phase: Removing high levels of pre -time.

- Bull/exponential phase: Parvalaik Bitcoin Price Advance.

Past Bear Markets (2015, 2018) lasted for 13–14 months, and the most recent Bitcoin Bear Bazaar suit in 14 months. The recovery phase is usually spread for 23–26 months, and the current 2025 bitcoin cycle comes within this range. However, unlike the previous bull markets, the breakout of bitcoin above the previous high levels was followed by a pullback instead of immediate bounce.

This bitcoin pullback may indicate a higher low, establishing the exponential phase of the 2025 bull market. Depending on the exponential steps of the 9–11-maing of the previous cycles, the price of bitcoin can be at the peak around September 2025, assuming that the bull cycle resumes.

Macro Risk affecting the price of bitcoin in Q3 2025

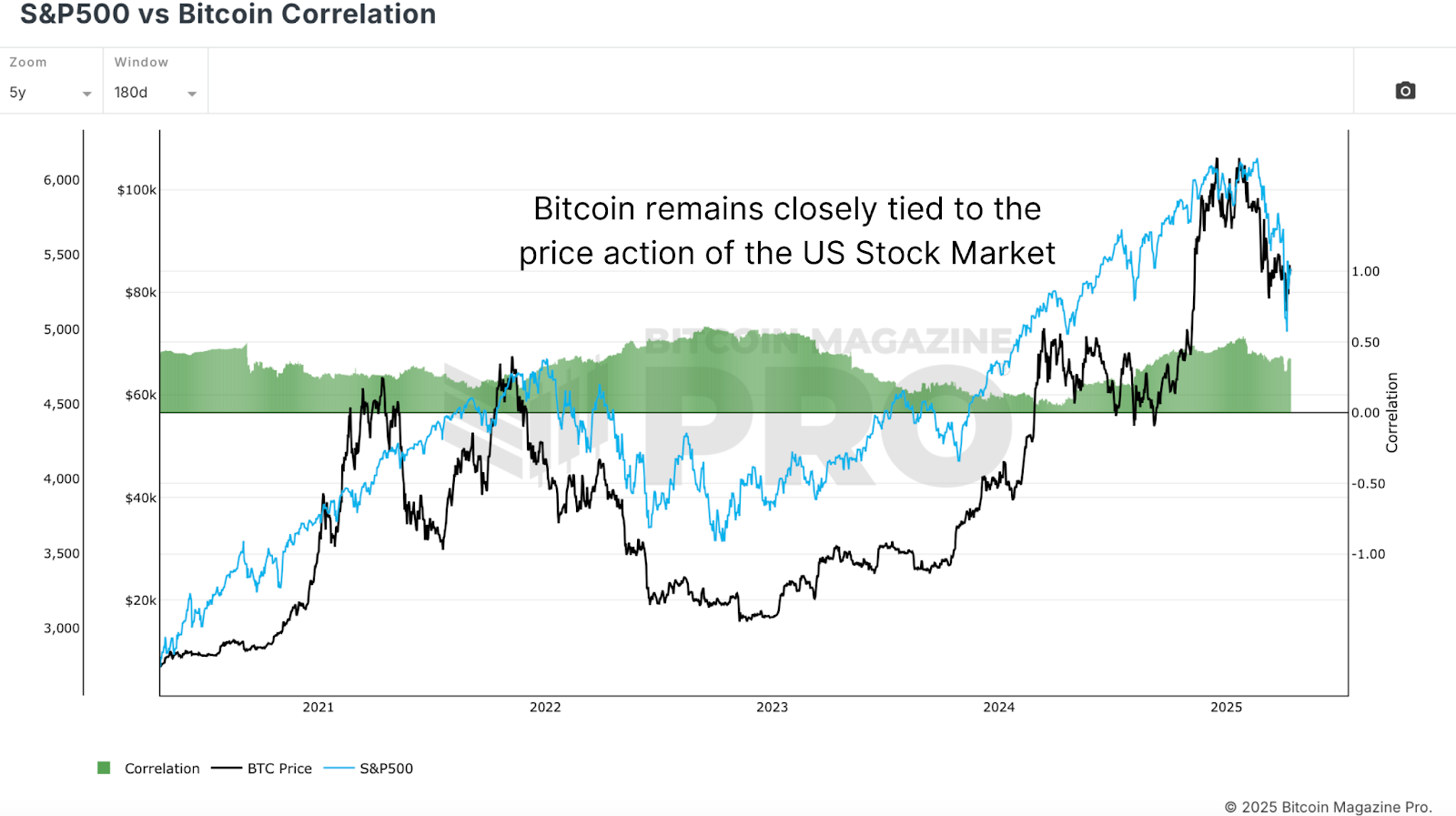

Despite the chain-chain indicators, the macro headwind 2025 pose a risk at the price of bitcoin. S&P 500 vs. bitcoin correlation The chart suggests that bitcoin is associated with American equity. With the possibility of increasing global recession, weakness in traditional markets may capable a close -term rally capacity of bitcoin.

It is important to monitor these macro risks, as a deteriorating equity market can trigger a deep bitcoin improvement in Q3 2025, even if on-chant data is helpful.

Conclusions: Bitcoin’s Q3 2025 Outlook

Key on-chain indicators-MVRV Z-score, Value Days were destroyed, and bitcoin cycle capital flow-point to healthy, bicycle-consistent behavior and long-term holder in 2025 bitcoin cycle. While slow and uneven, current cycle aligns with historical bitcoin market cycle structures compared to previous bull markets. If the position of the macro is stable, the bitcoin appears ready for another leg, potentially Q3 or Q4 is at the peak in 2025.

However, macro risk, including equity market volatility and fears of recession, are important for viewing. To make a deep dive, watch this YouTube video: Where we are in this bitcoin cycle,

For more intense research, technical indicators, real-time market alerts, and access to the growing community of analysts, travel Bitcoinmagazinepro.com,

Disclaimer: This article is only for informative purposes and should not be considered financial advice. Always do your own research before making any investment decision.